Finding the best car insurance for young drivers requires balancing cost and coverage. Young drivers often face higher premiums due to their limited experience and higher risk factors, making it essential to find options that are both affordable and reliable. With the right strategies, young drivers can secure cheap car insurance while still ensuring they are adequately protected. This guide will explore the reasons behind these higher costs, key factors to consider, and steps to find budget-friendly insurance options that meet your needs.

Why Car Insurance Costs More for Young Drivers

Young drivers generally pay higher premiums because they are considered high-risk customers by insurance companies. Their lack of driving experience and statistically higher likelihood of accidents lead to increased rates. Understanding why these premiums are higher can help you take steps to lower your costs and make smarter decisions when shopping for insurance.

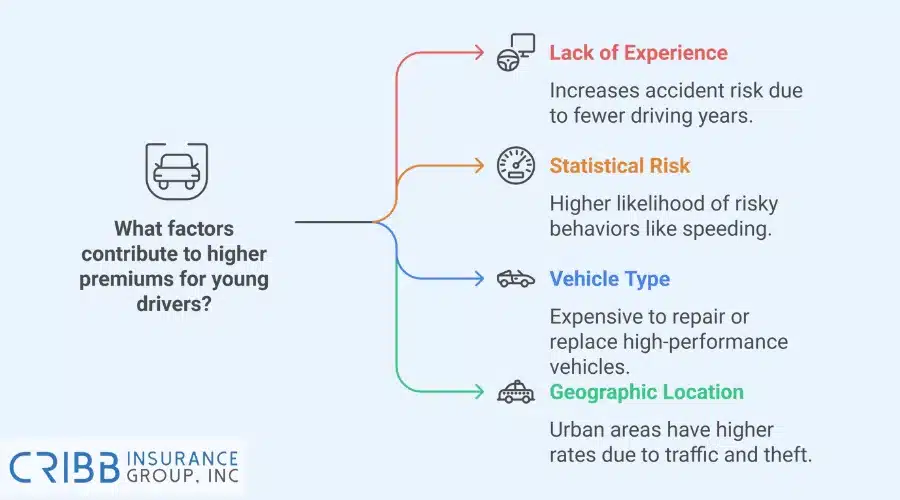

Key Factors Driving Higher Premiums for Young Drivers

Several factors contribute to higher insurance costs for young drivers. Insurers calculate premiums based on the likelihood of a claim being filed, and young drivers are more likely to be involved in accidents. Key reasons include:

- Lack Of Driving Experience: Young drivers have fewer years behind the wheel, increasing the risk of accidents.

- Statistical Risk: Drivers under 25 are more likely to engage in risky behaviors, such as speeding or distracted driving.

- Type Of Vehicle: High-performance or newer vehicles cost more to insure because they are expensive to repair or replace.

- Geographic Location: Urban areas often have higher insurance rates due to higher traffic density, theft risks, and repair costs.

By understanding these factors, young drivers and their families can make more informed decisions. For instance, choosing a vehicle with safety features or living in a less congested area may help reduce costs.

The Impact Of Risk And Limited Driving History

Young drivers’ limited driving history also plays a significant role in higher premiums. Insurers rely on driving records to assess risk, and new drivers lack the historical data that helps lower rates. A driver’s record typically reflects responsible behavior, such as avoiding accidents or traffic violations, which insurers use to determine premiums. The absence of this record means insurers often err on the side of caution, charging higher rates to offset the uncertainty. To address this, young drivers can:

- Complete Driver Education Programs: These courses can reduce perceived risk by showing insurers that the driver has undergone formal training.

- Maintain A Clean Record: Avoiding tickets, accidents, and claims over time builds a positive history.

- Participate In Graduated Driver Licensing Programs: These programs, required in many states, provide a structured approach to gaining experience and can reduce risk.

While young drivers will naturally pay more than experienced drivers, focusing on safe habits and participating in programs designed for new drivers can help them lower costs over time.

Smart Ways Young Drivers Can Save on Car Insurance

Finding cheap car insurance for young drivers often comes down to smart strategies and taking advantage of available opportunities. By knowing how to lower premiums and exploring modern options, young drivers can make car insurance more affordable without sacrificing coverage.

Leveraging Discounts Like Good Student Programs

Insurance companies offer various discounts specifically for young drivers to help reduce the high cost of premiums. These discounts reward responsible behavior and habits. Key programs include:

| Discount Type | Description | How It Saves |

|---|---|---|

| Good Student Discounts | Students with a “B” average or higher qualify. | Academic success signals responsibility. |

| Safe Driver Discounts | Clean driving record without accidents or violations. | Rewards safe driving habits. |

| Multi-Policy Discounts | Bundling car insurance with home or renters insurance. | Lowers overall insurance costs. |

| Defensive Driving Course Discounts | Completing approved driving courses. | Demonstrates commitment to safe driving. |

These discounts can add up, significantly reducing the overall cost of insurance for young drivers. Always ask insurers about specific eligibility criteria and how to qualify for these programs.

Exploring Pay-As-You-Drive and Telematics Options

Pay-as-you-drive and telematics programs are modern solutions that can make car insurance cheaper for young drivers by basing premiums on actual driving habits. These programs use technology to monitor behavior and reward safe driving. Key benefits of these programs include:

- Personalized Premiums: Insurance costs are adjusted based on how safely and how much you drive, offering lower rates for careful, low-mileage drivers.

- Real-Time Feedback: Telematics devices provide feedback on driving behaviors, such as hard braking, speeding, and cornering, encouraging safer habits.

- Flexibility: For drivers who only use their cars occasionally, usage-based insurance provides a cost-effective alternative to traditional plans.

Many insurers offer these programs, and young drivers who consistently drive safely can see noticeable reductions in their premiums. Ask your insurance provider about telematics options and how they calculate rates based on your driving data.

How Vehicle Choices Affect Car Insurance Costs

The type of vehicle young drivers choose can have a major impact on their car insurance premiums. Insurers assess a car’s risk factors, including its safety features, repair costs, and likelihood of theft, to determine rates. Choosing a vehicle strategically can help young drivers find cheap car insurance while maintaining reliable coverage.

Best Types of Vehicles for Affordable Premiums

Not all vehicles are equal when it comes to insurance costs. Young drivers looking for affordable premiums should focus on cars that are less expensive to repair and safer to drive. Some of the best types of vehicles for affordable premiums include:

| Vehicle Type | Why It’s Affordable | How It Lowers Premiums |

|---|---|---|

| Sedans and Compact Cars | Lower repair costs and reduced accident risk | Less expensive to repair and insure. |

| Older, Reliable Models | Lower replacement value and proven safety. | Costs less due to depreciation. |

| Family-Friendly Cars | Designed for safety with family-oriented features. | Safer design reduces accident risk. |

Avoid high-performance vehicles, luxury cars, and models with high theft rates, as they significantly increase premiums. Choosing a practical, safe vehicle can make a noticeable difference in overall insurance costs.

Safety Features That Reduce Insurance Costs

Safety features are another crucial factor that can lower insurance premiums. Insurers reward vehicles equipped with features that reduce the risk of accidents or limit damage during collisions. Key safety features that help reduce insurance costs include:

- Anti-Lock Brakes (ABS): Prevent skidding and improve control during sudden stops, lowering the likelihood of accidents.

- Airbags: Minimize injuries in crashes, which can reduce medical-related claim costs for insurers.

- Traction Control and Stability Systems: Help maintain control in slippery conditions, making accidents less likely.

- Anti-Theft Devices: Alarms, immobilizers, and GPS trackers reduce the risk of vehicle theft, lowering premiums for young drivers.

- Lane Assist and Automatic Emergency Braking (AEB): Advanced driver-assistance systems improve road safety and reduce claims for at-fault accidents.

When selecting a vehicle, prioritize these features to ensure safety while also taking advantage of insurance discounts for well-equipped cars. Always discuss with your insurer how safety features impact premiums to get the most accurate rates.

How to Choose the Right Insurance for Young Drivers

Selecting the right insurance involves more than just finding the cheapest option. Young drivers need a policy that balances affordability with adequate protection. Understanding different coverage types and evaluating what’s necessary can help them make informed choices that meet their needs and budget.

Understanding Coverage Types and What You Need

Car insurance policies include various coverage types, each designed to protect against specific risks. Knowing what each type covers helps young drivers decide what they need and avoid paying for unnecessary extras. Here are the main coverage types:

| Coverage Type | What It Covers | When It’s Needed |

|---|---|---|

| Liability Coverage | Damages or injuries caused to others in an at-fault accident. | Required in most states; essential for all drivers. |

| Collision Coverage | Repairs your car after an accident, regardless of fault. | Best for newer vehicles; optional for older cars. |

| Comprehensive Coverage | Non-collision incidents like theft, vandalism, or natural disasters. | Ideal for high-value cars or severe-weather areas. |

| Personal Injury Protection (PIP) | Medical expenses for you and your passengers after an accident. | Required in some states; helpful for medical coverage. |

| Uninsured/Underinsured Motorist Coverage | Costs from accidents with drivers who have little or no insurance. | Important if driving in areas with many uninsured drivers. |

Young drivers should consider their driving habits, vehicle value, and budget when deciding on coverage. For instance, liability-only insurance may work for older cars, while newer vehicles might need collision and comprehensive coverage for better protection.

Balancing Affordability With Adequate Protection

While finding cheap car insurance for young drivers is important, sacrificing essential coverage can lead to higher costs later. Striking the right balance ensures young drivers are protected without overpaying. Here are the steps to balance cost and coverage:

- Assess Your Vehicle’s Value: Older cars with lower market value may not need collision or comprehensive coverage. Focus on liability coverage instead.

- Understand State Requirements: Each state has minimum liability coverage limits. Ensure you meet these requirements while considering higher limits for added protection.

- Compare Deductibles: Higher deductibles lower premiums but increase out-of-pocket costs during claims. Choose a deductible that fits your financial situation.

- Explore Discounts: Look for good student discounts, multi-policy bundles, and safe driving incentives to offset costs without reducing coverage.

- Avoid Unnecessary Add-Ons: Skip extra features like roadside assistance if they are already included in your family’s plan or through another service.

By carefully evaluating these factors, young drivers can find a policy that keeps them protected on the road while staying within budget.

Common Misconceptions About Cheap Car Insurance

Many young drivers focus solely on finding the cheapest car insurance without fully understanding the trade-offs. While affordability is important, misconceptions about cheap car insurance can lead to inadequate protection or unexpected costs. Clearing up these misunderstandings helps young drivers make better decisions.

Why Cheapest Doesn’t Always Mean Best Coverage

The cheapest car insurance may save money upfront, but it often comes with limitations that can cost more in the long run. Low-cost policies might lack sufficient coverage, leaving young drivers vulnerable in the event of an accident. Here are common issues with overly cheap insurance policies:

- Low Liability Limits: A basic policy may only meet state minimum requirements, which might not cover all damages in a serious accident. The policyholder could be responsible for paying the remaining costs out of pocket.

- No Collision or Comprehensive Coverage: While liability-only insurance is cheaper, it won’t cover damage to your car from accidents, theft, or natural disasters.

- Restricted Customer Support: Some low-cost insurers may cut corners on claims processing and customer service, leading to delays and frustrations.

Young drivers should focus on policies that strike a balance between affordability and adequate protection. Spending slightly more on coverage that protects against unexpected costs can save significant money and stress over time.

The Importance of Reading Policy Details Carefully

Even affordable insurance can have hidden terms or exclusions that affect the coverage provided. Failing to review policy details carefully can result in unpleasant surprises when filing a claim. Here are critical policy elements to review:

- Coverage Limits: Verify the maximum amount the policy will pay for different types of claims, such as bodily injury or property damage.

- Deductibles: Check how much you’ll need to pay out of pocket before the insurance kicks in, and ensure it’s manageable for your budget.

- Exclusions: Understand what the policy doesn’t cover, such as specific types of damage or vehicles used for work purposes.

- Terms for Discounts: Discounts may come with conditions, like maintaining a certain GPA or installing telematics devices.

- Renewal Terms: Some cheap policies may have premiums that increase significantly after the first term.

Reading the fine print helps young drivers avoid unexpected costs and ensures they fully understand what their policy covers. Always ask your insurance provider questions if anything in the policy seems unclear.

How Cribb Insurance Group Inc Helps Young Drivers Save on Insurance

Cribb Insurance Group Inc understands the unique challenges young drivers face when it comes to finding affordable and reliable car insurance. In Bentonville, AR, we work with young drivers to identify cost-saving opportunities like discounts, usage-based insurance programs, and multi-policy options, helping them achieve the right balance of cost and coverage.

By choosing Cribb Insurance Group Inc, young drivers can gain access to personalized advice and tailored policies that address their needs. With a focus on transparency and customer satisfaction, we aim to help families and young drivers protect what matters most without exceeding their budget.

Frequently Asked Questions

How can I switch to a cheaper insurance provider without penalties?

Switching to a cheaper insurance provider can be done by reviewing your current policy’s cancellation terms. Many providers allow cancellation at any time, but some may charge fees. Compare new providers, ensure there’s no lapse in coverage, and align your start date with your previous policy’s end date to avoid penalties or legal issues.

Does adding a young driver to a family policy always save money?

Adding a young driver to a family policy often reduces costs compared to getting them a standalone policy. However, the exact savings depend on factors like the family’s driving history, vehicle types, and existing discounts. Bundling multiple drivers under one policy can also qualify for multi-driver or multi-policy discounts.

Can young drivers get insurance without owning a car?

Yes, young drivers can get non-owner car insurance. This type of policy covers liability if the driver causes an accident while driving a vehicle they don’t own. It’s a good option for young drivers who frequently borrow cars but don’t need full coverage policies.

How do credit scores affect car insurance rates for young drivers?

In many states, insurance companies use credit scores to help determine premiums. A low credit score may indicate higher financial risk, leading to higher rates. Young drivers can lower premiums by building credit, such as paying bills on time or becoming an authorized user on a parent’s credit card.

What is the role of state laws in determining insurance costs?

State laws significantly impact insurance costs by setting minimum liability requirements and regulating how providers calculate premiums. For example, some states prohibit using credit scores in rate determinations, while others have stricter coverage requirements. Understanding Bentonville, AR’s specific laws helps young drivers choose compliant and affordable policies.

Take the First Step to Affordable Insurance

Ready to find the best car insurance for young drivers in Bentonville, AR? Call Cribb Insurance Group Inc at (479) 273-0900 today for expert guidance and personalized quotes. Let us help you secure affordable and reliable insurance that fits your needs.