Buying car insurance for the first time is a big step toward financial responsibility and independence as a driver. Whether you’re leaving a family policy or insuring your very first car, it’s important to understand how policies work and what influences their cost. This guide covers all the essentials of buying car insurance for the first time, offering practical advice and tips tailored to first time buyers. If you’re searching for car insurance for first time drivers, this resource will help you make confident and informed decisions.

What First Time Car Insurance Buyers Need to Know

First time car insurance buyers face unique challenges, from understanding coverage types to navigating factors that affect premiums. Learning these essentials can simplify the process and help you avoid costly mistakes.

Basics of Car Insurance for Beginners

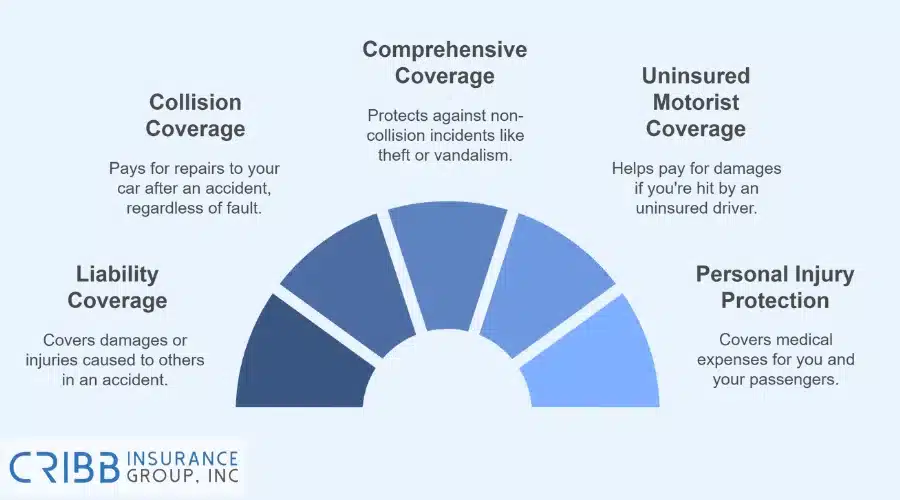

Car insurance is designed to protect drivers from financial losses due to accidents, theft, or damages. For first time buyers, it’s crucial to know the different types of coverage and how they work together:

- Liability Coverage: This is required by most states and pays for damages or injuries you cause to others in an accident.

- Collision Coverage: Covers repairs to your car after an accident, regardless of fault.

- Comprehensive Coverage: Protects against non-collision incidents like theft, vandalism, or natural disasters.

- Uninsured Motorist Coverage: Helps pay for damages if you’re hit by someone without insurance.

- Personal Injury Protection (PIP): Covers medical expenses for you and your passengers, regardless of who is at fault.

Understanding these options ensures you can meet legal requirements while also protecting yourself against unexpected expenses.

Common Factors Affecting Premiums and Coverage

Insurance premiums vary significantly depending on several factors. Being aware of these influences helps you budget effectively and find the right policy:

- Driving Record: A history of accidents or violations increases premiums, while a clean record helps lower them.

- Age and Experience: Less experienced and younger drivers often face higher costs due to perceived risk.

- Vehicle Type: Cars with high safety ratings or lower repair costs typically have lower premiums.

- Location: Living in areas with high traffic or crime rates can result in higher insurance costs.

- Credit History: In some states, insurers use credit scores to determine premium rates.

By understanding these factors, you can take proactive steps to manage costs, such as driving safely, choosing a budget-friendly vehicle, and maintaining good credit.

How to Choose the Best Car Insurance for Your Needs

Finding the best car insurance policy for the first time involves comparing options, understanding coverage limits, and tailoring the policy to your unique needs. Making informed choices now can save you money and stress later.

Comparing Coverage Options for First Time Buyers

First time buyers need to evaluate their coverage options carefully to ensure they are adequately protected. Consider these aspects when comparing policies:

- State Requirements: Verify the minimum liability coverage mandated in your state and decide if additional coverage is necessary for your protection.

- Optional Coverage: Add-ons like roadside assistance, gap insurance, and rental reimbursement can provide extra security and convenience.

- Insurance Provider Perks: Look for unique benefits such as accident forgiveness, bundling discounts, or access to user-friendly mobile apps.

Take time to gather quotes from multiple providers. Compare not just the price but also the value-added features that align with your needs as a first time buyer.

Key Tips for Selecting the Right Deductible

The deductible plays a critical role in determining your monthly premiums and out-of-pocket expenses during a claim. Use these tips to choose a deductible that fits your situation:

- Understand the Trade-Off: Higher deductibles lower premiums but increase your financial responsibility during a claim. Lower deductibles raise premiums but minimize costs after an accident.

- Assess Your Budget: Select a deductible you can comfortably pay in case of an emergency. This is especially important for first time buyers who may have limited savings.

- Evaluate Your Risk: Drivers who commute frequently or operate in high-risk areas may benefit from a lower deductible, providing more peace of mind.

- Coordinate Deductibles: If you opt for multiple coverages, such as collision and comprehensive, try to align the deductibles for consistency.

Making the right choice depends on your financial readiness and your driving habits. Strike a balance that offers both affordability and protection.

Steps to Buy Car Insurance for the First Time

Buying car insurance for the first time involves a series of steps that ensure you are adequately prepared and well-informed. Understanding these steps will help you secure the right policy with minimal stress.

Gather Necessary Information and Documents

Before you can apply for car insurance, you need to gather specific documents and details about yourself and your vehicle. Having this information ready ensures a smoother process when you contact insurance providers. Here’s what you’ll typically need:

- Driver’s License: You’ll need your valid driver’s license to confirm your eligibility to drive. If you recently obtained your license, be prepared to provide the date it was issued.

- Vehicle Information: Collect details about the car you’re insuring, including the Vehicle Identification Number (VIN), make, model, and year. If the car is financed, you’ll also need loan or leasing company details.

- Proof of Address: Insurers require your current residential address to calculate your premium based on your location. This can be a utility bill or another official document.

- Banking or Payment Details: If you plan to set up automatic payments, ensure you have your bank account or credit card information ready.

- Driving History: Some insurers may ask for information about past accidents, violations, or claims, so be prepared to discuss your record.

Having this information readily available can save you time and help insurance agents provide you with accurate quotes.

Compare Insurance Providers and Request Quotes

Once your documents and information are prepared, the next step is to research and compare different insurance providers. Finding the right insurer involves understanding their policies, services, and pricing. Follow these steps to compare effectively:

- Research Reputable Providers: Start by identifying well-known insurance companies that offer coverage in your area. Read reviews and ask friends or family for recommendations.

- Request Multiple Quotes: Contact at least three providers to request personalized quotes based on your details and coverage needs. Make sure each quote includes the same coverage types and limits for a fair comparison.

- Evaluate Coverage Options: Review the specifics of each policy, including liability limits, deductibles, and optional add-ons like roadside assistance or rental reimbursement.

- Ask About Discounts: Inquire about potential discounts for first time buyers, safe drivers, or bundling with other insurance policies.

- Review Customer Support and Perks: Choose a provider that offers reliable customer service and perks like mobile app access or 24/7 claims assistance.

Taking the time to compare policies helps ensure you get the best coverage for your needs and budget.

Tips to Save Money on Your First Car Insurance Policy

Car insurance for first time buyers can be expensive, but there are practical strategies to reduce costs without sacrificing coverage. By understanding the discounts available and adopting smart driving habits, you can save significantly on your premiums.

Discounts for New Drivers to Ask About

Many insurance providers offer discounts specifically tailored for first time or younger drivers. These discounts can make a noticeable difference in your premium. Here are some of the most common discounts to inquire about:

- Good Student Discount: If you’re a student with a strong academic record, you may qualify for a discount. Insurers often require a minimum GPA or proof of being on the honor roll.

- Safe Driver Discount: Drivers with no history of accidents or traffic violations can benefit from this discount. It rewards responsible driving behavior, which insurers see as lower risk.

- Driver’s Education Discount: Completing a certified driver’s education or defensive driving course can demonstrate your commitment to safety and reduce your premium.

- Low Mileage Discount: If you don’t drive frequently, insurers may offer a discount based on your lower likelihood of being involved in an accident.

- Bundling Discounts: Consider combining auto insurance with other policies, such as renters or homeowner’s insurance, to receive a lower rate on all policies.

When shopping for insurance, ask each provider about the discounts they offer and their eligibility requirements. Combining multiple discounts can lead to significant savings.

The Impact of Maintaining a Clean Driving Record

Maintaining a clean driving record is one of the most effective ways to keep your insurance premiums low. Insurers assess your driving history to gauge your risk level, and avoiding accidents and violations positions you as a safer driver in their eyes. Here’s how it helps:

- Lower Risk Equals Lower Premiums: A clean driving record signals to insurers that you are less likely to file claims, making you eligible for better rates over time.

- Eligibility for Safe Driver Discounts: Many providers offer substantial discounts for drivers who remain accident- and violation-free for a set number of years.

- Improved Renewal Rates: When your policy is up for renewal, insurers review your record. Consistently safe driving can prevent rate increases and may even lead to lower premiums.

- Avoiding Surcharges: Traffic violations, such as speeding tickets or DUIs, can result in surcharges or higher premiums for several years.

To maintain a clean record, always obey traffic laws, avoid distractions while driving, and practice defensive driving techniques. Even as a first time driver, building good habits now will pay off in the long run.

Common Mistakes to Avoid with First Time Car Insurance

First time car insurance buyers often make avoidable mistakes that lead to higher costs or inadequate coverage. By being aware of these pitfalls, you can make better decisions and secure a policy that meets your needs without unnecessary expenses.

Not Comparing Multiple Insurance Providers

One of the most common mistakes is settling for the first insurance provider you come across without comparing other options. Each provider offers different rates, discounts, and coverage features, and failing to shop around can result in missed opportunities for savings and better protection. Here’s why comparing providers is crucial:

- Rate Variations: Insurance premiums can differ significantly between companies, even for identical coverage. Without multiple quotes, you might end up overpaying.

- Unique Discounts: Some insurers specialize in offering discounts for specific demographics, such as first time drivers or students. Exploring multiple options increases your chances of finding these benefits.

- Coverage Differences: Providers may package their policies differently, offering unique perks like accident forgiveness, gap insurance, or bundled policies. Comparing these features ensures you choose the one that suits your needs.

When comparing providers, request at least three quotes with similar coverage limits and deductibles. Evaluate not just the price but also the overall value, including customer service ratings and additional benefits.

Choosing Insufficient or Excessive Coverage

Another common error is either underestimating or overestimating your coverage needs. Both can lead to unnecessary financial stress. Here’s how to strike the right balance:

- Insufficient Coverage: Choosing only the minimum liability coverage required by your state might seem cost-effective initially, but it could leave you vulnerable in case of major accidents or lawsuits. For example, if damages exceed your liability limits, you’ll be personally responsible for the difference.

- Excessive Coverage: Over-insuring by adding unnecessary options can inflate your premiums. For instance, if your car is old and has a low market value, opting for comprehensive and collision coverage might not be worth the cost.

To avoid these extremes, assess your financial situation, vehicle value, and driving habits. Consult with an insurance agent to understand what coverage types and limits are appropriate for your specific circumstances. The right balance ensures you’re protected without paying for coverage you don’t need.

Why First Time Drivers Choose Cribb Insurance Group Inc

Buying car insurance for the first time doesn’t have to be stressful. By understanding your coverage options, comparing providers, and avoiding common mistakes, you can secure a policy that fits your needs and budget. First time drivers in Bentonville, AR, trust Cribb Insurance Group Inc to provide personalized advice, competitive rates, and coverage tailored to their unique situations.

At Cribb Insurance Group Inc, we’re committed to making the process of buying your first car insurance policy simple and transparent. Our team can help you understand the details, find applicable discounts, and choose a plan that balances cost and coverage. Whether you’re a first time buyer or need guidance, our experts are here to support you every step of the way.

Frequently Asked Questions

What Happens If I Miss a Payment on My Policy?

Missing a payment can lead to consequences like late fees or even a policy cancellation. Many insurers provide a grace period to make the payment, but it’s important to contact your provider immediately to avoid lapses in coverage. Reinstating a canceled policy may result in higher premiums.

Do All States Require Car Insurance?

No, not all states require car insurance, but most do. States like New Hampshire allow drivers to opt-out if they can prove financial responsibility. However, it’s always a good idea to have insurance to protect yourself from potential liability and repair costs after an accident.

Can I Cancel My Policy Without Penalty?

Canceling a car insurance policy is generally allowed, but there may be penalties or fees, especially if you cancel before the end of the policy term. Check with your insurer about their cancellation policy, as some may refund a portion of unused premiums if you’ve prepaid.

What Should I Do If I Get Into an Accident?

If you’re involved in an accident, ensure everyone is safe and call emergency services if needed. Exchange information with the other driver, document the scene with photos and notify your insurance provider as soon as possible to start the claims process.

Are There Insurance Options for Temporary Coverage?

Yes, many insurers offer temporary coverage options, such as short-term policies or non-owner car insurance. These plans are ideal for drivers who need insurance for a limited time, such as borrowing a vehicle or driving a rental car. Check with your provider for availability and terms.

Get Affordable Car Insurance in Bentonville, AR

Cribb Insurance Group Inc is here to make buying car insurance for the first time easy and affordable. Our team of experts in Bentonville, AR, is ready to help you find the coverage you need. Call us today at (479) 286-1066 and take the first step toward securing your peace of mind.