When the unexpected happens, like your car breaking down or needing to borrow a friend’s vehicle for a quick errand, you might find yourself asking: Can you drive someone else’s car without insurance? While the idea seems straightforward, the reality involves various considerations that can impact your legal and financial safety. Let’s explore the ins and outs of this common situation to help you stay informed.

Understanding How Insurance Works When You Borrow a Car

Borrowing a car might feel like borrowing anything else—straightforward and simple. However, when it comes to car insurance, it’s not so black and white. Here’s how it typically works:

The Owner’s Insurance Policy

Most insurance policies follow the car rather than the driver. If you have permission to drive someone’s car, their insurance likely extends to you. However, coverage isn’t universal. Some policies limit who is considered a “permissive driver,” so it’s wise to clarify this with the vehicle owner beforehand.

What About Your Insurance?

While most insurance coverage follows the car, your personal auto insurance can act as a secondary policy to fill in gaps. For example, if damages exceed the limits of the owner’s policy, your insurance might cover the remaining costs—if your policy includes such provisions. It’s important to check with your insurance provider to confirm how your coverage applies when driving a car you don’t own.

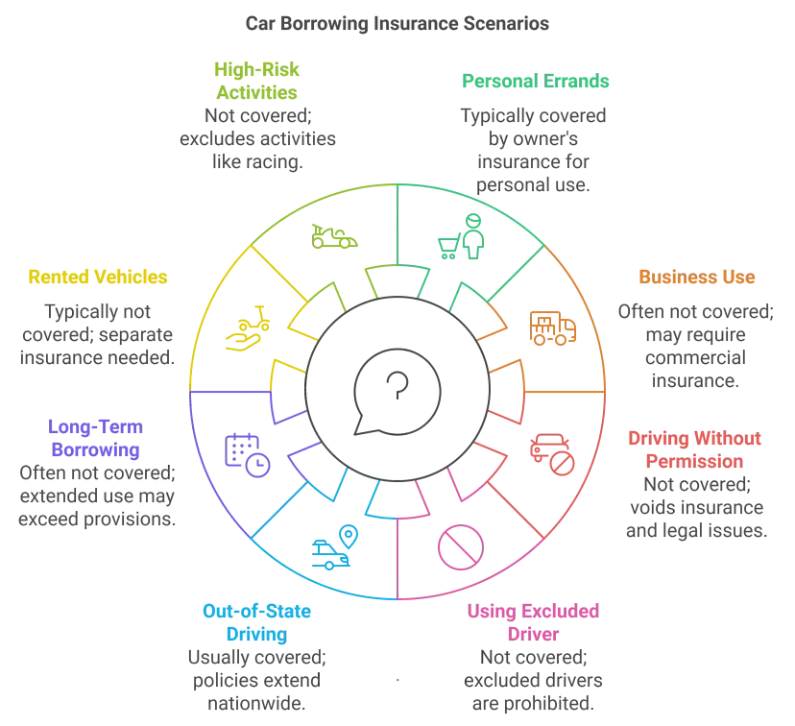

Common Scenarios and Coverage

To help you understand how coverage might apply when borrowing a car, here’s a breakdown of common scenarios and whether the owner’s insurance is likely to cover them:

| Scenario | Covered by Owner’s Insurance? | Notes |

|---|---|---|

| Personal Errands (e.g., grocery run) | Yes, typically covered | Most policies include permissive use for occasional personal errands. |

| Business Use (e.g., deliveries) | Often Not Covered | Business-related use may require commercial auto insurance. Confirm with the policyholder. |

| Driving Without Permission | Not Covered | Driving without explicit consent may void coverage and lead to legal consequences. |

| Using an Excluded Driver | Not Covered | Policies often list excluded drivers who are not permitted to operate the vehicle. |

| Accident While Driving Out of State | Yes, typically covered | Most policies extend coverage nationwide, but confirm policy details for out-of-state use. |

| Long-Term Borrowing (e.g., over a month) | Often Not Covered | Extended use may fall outside “occasional” driver provisions. Consider temporary insurance. |

| Rented Vehicles | Often Not Covered | Rental cars require separate insurance or coverage through a credit card or rental agreement. |

| High-Risk Activities (e.g., racing) | Not Covered | Insurance policies exclude coverage for activities like racing or off-road use. |

| Car Share Platforms (e.g., Turo) | May or may not be covered | Some policies exclude coverage for vehicles listed on car-sharing platforms. Verify beforehand. |

This guide provides a quick, clear reference for determining whether a borrowed car is covered under the owner’s insurance in various situations. Always confirm the details with the vehicle owner and their insurance provider to avoid surprises.

Key Considerations Before Getting Behind the Wheel

Before taking the keys to a car that’s not your own, it’s essential to think through some critical points. One key area to prepare for is knowing what to do in case of an accident. Here’s a practical how-to guide to help you stay calm and handle the situation efficiently.

1. Ensure Safety First

- Move to a Safe Location: If the car is drivable and it’s safe to do so, pull over to the side of the road to prevent further accidents. Turn on hazard lights.

- Check for Injuries: Make sure everyone involved is okay. Call emergency services (911) if there are any injuries.

2. Contact the Car Owner

- Notify Them Immediately: Call the car owner to inform them about the accident. They need to know right away since their insurance will likely be involved.

- Discuss Next Steps: Ask them where their insurance documents are located and how they’d prefer you to proceed.

3. Locate and Document Insurance Information

- Find the Insurance Card: The insurance card is typically stored in the glove compartment. If you can’t find it, the owner should be able to provide the information over the phone.

- Take Photos of the Documents: Take a clear picture of the insurance card and the vehicle registration for your records.

4. Exchange Information with the Other Driver

- What to Exchange: Share and collect details like names, phone numbers, license plate numbers, and insurance policy information.

- Use a Checklist: Write down the date, time, location of the accident, and descriptions of the vehicles involved.

5. Document the Scene

- Take Photos or Videos: Capture images of the vehicle damage, license plates, road conditions, and any visible injuries.

- Draw a Diagram: Create a simple sketch of how the accident happened to help explain the event to insurance providers later.

6. File a Police Report (if necessary)

- When to Call the Police: If the accident involves injuries, significant property damage, or disputes, contact the police to file an official report.

- Ask for a Report Number: Get the report number and contact details of the officer on the scene.

7. Contact the Insurance Provider

- Call the Owner’s Insurance Company: Use the number on the insurance card to report the accident. Provide all requested details about the incident.

- Follow Up: Check with the car owner about the claims process and whether your own insurance might be needed as secondary coverage.

8. Follow Post-Accident Best Practices

- Avoid Admitting Fault: Stick to factual information when discussing the accident; let the insurance companies determine fault.

- Get a Vehicle Inspection: Arrange for the car to be inspected for damages, even if they seem minor.

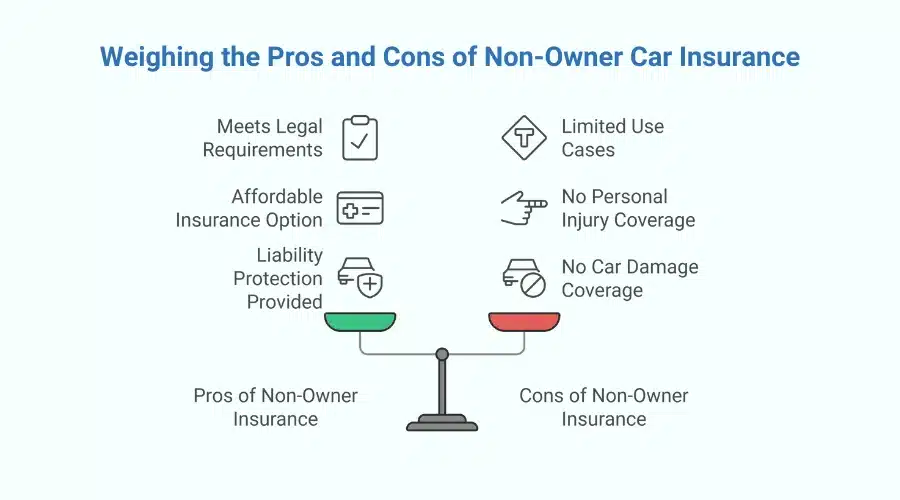

Non-Owner Car Insurance: A Safety Net for Borrowers

Non-owner car insurance can be an excellent option for individuals who frequently borrow vehicles or don’t own a car. However, like any insurance policy, it comes with its own set of advantages and limitations. Here’s a breakdown to help you weigh the pros and cons:

Pros and Cons of Non-Owner Car Insurance

| Pros | Cons |

|---|---|

| Provides Liability Protection: Covers damages you may cause to others while driving. | Does Not Cover the Borrowed Car: Won’t pay for damages to your vehicle. |

| Affordable Option: Costs less than standard auto insurance, as it focuses only on liability coverage. | No Personal Injury Coverage: Excludes medical expenses for you or your passengers. |

| Meets State Legal Requirements: Satisfies liability insurance mandates for drivers without a car. | Limited Use Cases: Not suitable for regular use of a specific car; owner’s insurance is still necessary. |

| Flexibility Across Vehicles: Covers liability when driving various borrowed or rented cars. | No Comprehensive or Collision Coverage: Offers no protection for theft, weather damage, or similar events. |

| Ideal for Frequent Renters: Helps avoid paying for liability insurance at rental agencies. | Requires Borrowed Car to Be Insured: Assumes the vehicle owner has valid insurance. |

Non-owner car insurance provides liability coverage for drivers who borrow cars occasionally or rent vehicles regularly. However, it does not replace the need for the vehicle owner to have comprehensive coverage, nor does it address personal injury or property damage to the borrowed vehicle.

If you frequently borrow or rent cars, this insurance type may be worth considering. However, always verify the owner’s policy and confirm your needs with an insurance professional.

Legal Implications of Driving Without Insurance

Driving a car without proper insurance coverage can have serious consequences. Beyond financial risks, there are legal repercussions that vary by state and broader societal impacts.

Increased Financial Risk

If you’re involved in an accident and the vehicle isn’t adequately insured, you could be held personally liable for damages. This includes property damage, medical bills, and even legal fees if the other party sues.

Impact on Credit Score

Failure to pay fines, court-ordered settlements, or damages resulting from an uninsured accident could negatively affect your credit score, making it harder to secure loans or credit in the future.

Criminal Charges

In some states, repeat offenses for driving without insurance can escalate to criminal charges, including potential jail time.

Difficulty Renewing Vehicle Registration

Many states require proof of insurance to renew a vehicle’s registration. Driving a vehicle with expired registration could add further penalties to your record.

Statistics on Uninsured Driving

Uninsured driving remains a widespread issue with significant impacts:

- 14% of U.S. drivers were uninsured in 2022, according to the most recent data from the Insurance Research Council (IRC).

- Mississippi and Michigan reported the highest uninsured driver rates, at 29.4% and 25.5%, respectively.

- The National Association of Insurance Commissioners (NAIC) reports that insured drivers bear the financial burden of uninsured driving, which costs them a staggering $13 billion annually in added premiums.

Note: These statistics can change over time, so it’s always a good idea to consult the latest data from reliable sources like the Insurance Research Council or the National Association of Insurance Commissioners.

Why It Matters

Uninsured driving affects more than just the driver—it puts everyone at risk. Victims of accidents involving uninsured drivers often face difficulty recovering damages, while offenders deal with fines, license suspensions, and long-term financial challenges like higher insurance premiums or legal costs.

Real-World Scenarios: When You Might Need Extra Coverage

While most of us borrow a car under normal circumstances, some situations might warrant special attention:

Road Trips or Long-Term Use

Are you borrowing a car for an extended period? Check if the owner’s insurance policy restricts long-term or out-of-state use.

Rental Cars and Borrowed Vehicles

Consider temporary insurance policies if you’re borrowing a car for a special occasion or road trip. These are short-term solutions that provide coverage without long-term commitments.

Tips for Borrowing a Car Safely

- Communicate Clearly: Always confirm insurance details and vehicle condition with the owner.

- Have Your Information Handy: Keep your driver’s license and any applicable insurance policy documents with you.

- Drive Responsibly: Avoid any reckless behavior that could lead to accidents or legal issues.

- Know Your State Laws: Laws vary by state, so ensure you know local requirements.

Why This Matters for Your Peace of Mind

Driving someone else’s car without understanding the insurance implications can lead to unexpected complications. From legal and financial risks to ensuring proper coverage, every decision matters. Being informed and proactive helps protect you, the car owner, and everyone else on the road. Whether you’re borrowing a car for a short errand or considering non-owner insurance for frequent use, knowing the rules about whether you can drive someone else’s car without insurance can save you from future headaches.

At Cribb Insurance Group Inc, we’re here to help you navigate these situations. Our Bentonville, AR team specializes in providing clear, tailored advice to suit your unique insurance needs. Protecting you and your family is more than our job—it’s our commitment.

Frequently Asked Questions

Can I drive someone else’s car without being on their insurance policy?

Yes, as long as their insurance policy allows permissive use and covers occasional drivers.

Does my own insurance cover me when driving another person’s car?

In many cases, yes, but it often serves as secondary coverage to the owner’s insurance.

What happens if I get into an accident while driving someone else’s car?

The car owner’s insurance is typically the primary coverage, but you may still be liable for deductibles or damages exceeding the policy limits.

Is non-owner car insurance expensive?

While costs vary, non-owner car insurance is generally affordable compared to standard policies. Consult with an insurance professional for personalized advice.

Can I drive an uninsured car if I have my own insurance?

No, driving an uninsured vehicle is illegal in most states, even if you have your own policy.

Let’s Make Insurance Easy for You

If you’re unsure about your coverage or have questions about driving someone else’s car, the team at Cribb Insurance Group Inc in Bentonville, AR, is ready to help. With our expertise, we’ll ensure you’re protected no matter the situation. Contact us today to explore your options and drive with confidence.