When you’re shopping for auto insurance, there’s one question that might not cross your mind immediately: do auto insurance companies check your credit? For many, the answer can feel surprising and even a little puzzling. Why would your credit history matter for an auto insurance policy? As it turns out, there’s a lot more to this practice than meets the eye. Let’s break it down in a way that’s straightforward, conversational, and easy to understand.

Why Auto Insurance Companies Use Your Credit Score

Imagine your credit score as a snapshot of how you handle financial responsibilities. Auto insurance companies view this snapshot as a tool to predict risk. Studies show that individuals with lower credit scores are statistically more likely to file claims, and insurance companies are all about minimizing risk. This isn’t about judging your character but about using data to guide pricing decisions.

Here’s an analogy: Think of it like a weather forecast. While it’s not guaranteed to rain just because there are clouds, the forecast helps you decide whether to carry an umbrella. Similarly, your credit score acts as a forecast for insurers to estimate the likelihood of claims.

What Is a Credit-Based Insurance Score?

Credit-based insurance scores are different from regular credit scores. Instead of measuring your ability to repay loans, they estimate how likely you are to file an insurance claim. Factors like payment history and outstanding debt matter, but details like your income or spending habits aren’t included.

Here’s a quick example to make this clearer: Let’s say two drivers, Alex and Taylor, both apply for the same policy. Alex has a strong history of on-time payments, while Taylor has a few late payments and high credit utilization. Based on this data, the insurer might determine Alex is a lower risk, resulting in a lower premium.

States That Limit Credit Checks for Insurance

Before you worry about your credit affecting your premiums, it’s important to note that not all states allow this practice. States like California, Massachusetts, and Hawaii have regulations prohibiting insurers from using credit scores in determining rates. This means that if you’re a resident of one of these states, your credit history stays separate from your insurance policy.

For Arkansas residents, however, credit can still play a role. This makes understanding how your score impacts your premium all the more essential.

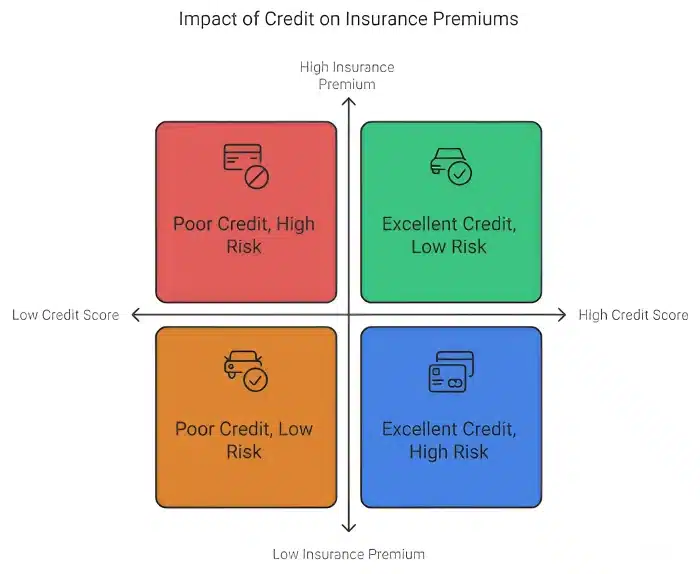

How Credit Affects Insurance Premiums

So, how much does your credit score really matter? While the specifics vary by insurer, studies suggest that drivers with poor credit can pay significantly more—sometimes double—than those with excellent credit. For families in Bentonville or Fayetteville, this can mean the difference between staying within budget or feeling stretched.

It’s a bit like the difference between safe and risky drivers. Just as someone with multiple speeding tickets might face higher premiums, someone with poor credit may be seen as a higher-risk policyholder. That said, it’s just one piece of the puzzle; your driving history and vehicle type still carry significant weight.

Tips for Improving Your Credit-Based Insurance Score

If your credit history isn’t where you’d like it to be, don’t worry—there’s always room for improvement. Here are some actionable steps to help you out:

- Pay Bills on Time: Your payment history is one of the biggest factors affecting your credit score.

- Keep Balances Low: High credit utilization can signal financial stress, so aim to use less than 30% of your available credit.

- Check Your Credit Report: Errors on your credit report can lower your score. Dispute inaccuracies as soon as you spot them.

- Build Long-Term Credit: If possible, keep old accounts open to show a longer credit history.

Improving your credit score isn’t an overnight process, but it pays off in more ways than one—including potentially lowering your insurance premiums.

Alternatives for Drivers with Low Credit

If you’re worried about your credit affecting your rates, there are options available:

| Alternative | Pros | Cons |

|---|---|---|

| Independent Agencies | – Access to multiple insurance providers.

– Tailored policy options. – Personalized service. | – Takes time to compare multiple policies.

– Availability depends on location. |

| No-Credit-Based Policies | – No credit check required.

– Focuses on driving history and other factors. | – Limited availability.

– May have higher baseline premiums. |

| Focus on Driving Record | – Clean driving record can offset low credit.

– Rewards safe driving habits. | – Requires a consistently good driving record.

– Other factors may still impact rates. |

| State-Regulated Policies | – Some states prohibit credit-based pricing.

– Simplifies rate determination. | – Limited to specific states like California, Massachusetts, and Hawaii. |

| Usage-Based Insurance | – Premiums based on driving habits (mileage, speed, etc.).

– Potential savings for safe drivers. | – Requires tracking devices or mobile apps.

– Privacy concerns for some drivers. |

Key Takeaways:

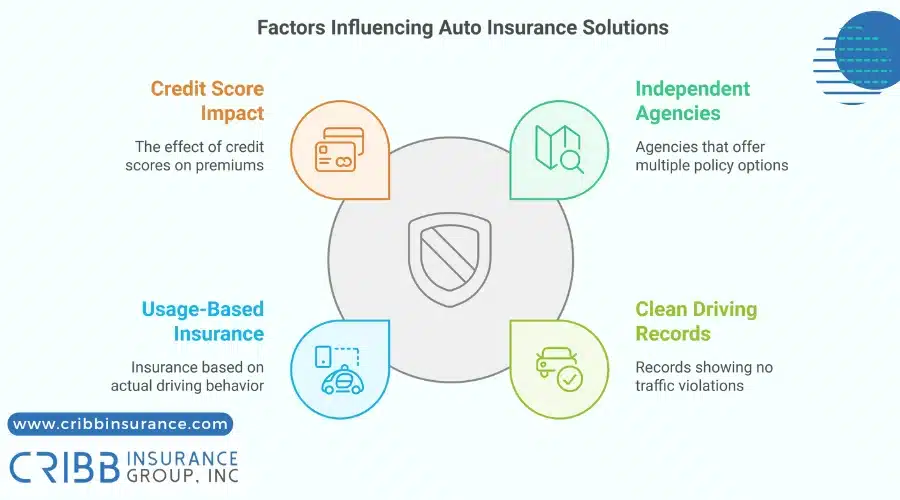

- Independent agencies and no-credit-based policies are excellent options for personalized and flexible solutions.

- A clean driving record can be a strong compensatory factor for drivers with low credit.

- Usage-based insurance offers an innovative option but may not appeal to everyone due to tracking requirements.

Not sure which option is best for you? We can guide you through the process and help you explore policies that suit your unique needs. Reach out to us to find a solution that works for you—no matter your credit score

The Debate: Is It Fair to Use Credit in Insurance?

The use of credit scores in auto insurance pricing has been debated. Supporters argue that it’s a data-backed method to assess risk, helping insurers set rates that align with claim likelihood. Critics, however, highlight that this practice can disproportionately affect individuals experiencing temporary financial difficulties, such as job loss or unexpected expenses, even if they have excellent driving records.

The Consumer Financial Protection Bureau study shows that individuals with lower credit scores are more likely to file claims, which insurers use to justify higher premiums.

While opinions differ, consumers need to understand how this system works. Being informed about your options and the role credit plays in setting premiums empowers you to navigate the process and secure the best possible coverage for your needs.

How Independent Insurance Agencies Can Help

Navigating insurance complexities, especially those involving credit, is easier with an independent agency. Unlike single-provider insurers, independent agencies can shop around for policies tailored to your unique situation. If your credit score isn’t perfect, they can find companies that focus more on other factors, such as your driving record or claims history.

Independent agencies also offer personalized guidance, helping you understand policy options and make confident decisions. With their flexibility and customer-first approach, they can help you secure a policy that works best for you—credit score and all.

Personalized Support from Local Experts

If you’re in Bentonville or the surrounding area, Cribb Insurance Group Inc is here to help. As an independent agency, they offer personalized service and access to multiple providers, helping you find the best auto insurance policy—regardless of your credit score. They’re committed to empowering families with the knowledge and tools needed to make informed insurance decisions.

Frequently Asked Questions

How does my credit score impact car insurance quotes?

Your credit score can influence the premiums insurers offer. A higher score typically translates to lower rates because it signals lower risk

Does checking my credit for insurance affect my credit score?

No, insurance-related credit checks are soft inquiries and do not impact your credit score.

Can improving my credit lower my insurance costs?

Yes, improving your credit score often leads to better rates. Paying bills on time and reducing debt are key steps to improvement.

How can I find insurers that don’t check credit scores?

Independent agencies can connect you with insurers that prioritize factors like driving records instead of credit scores.

What other factors affect my auto insurance premium?

Driving history, vehicle type, age, and location are significant factors in addition to credit scores.

Get Personalized Auto Insurance Quotes Today!

At Cribb Insurance Group Inc, we understand that navigating auto insurance can feel overwhelming. That’s why we’re here to guide you every step of the way. If you’re in Bentonville or the surrounding area, call or stop by to learn how we can help you find a policy that meets your needs—credit score and all.

Take control of your insurance journey today!