Renting out your home through platforms like Airbnb or Vrbo is a great way to earn extra income, but it also comes with risks that require careful planning. That’s why having home sharing insurance is crucial for protecting your property and finances. For those renting their homes regularly, rent house insurance offers added peace of mind by covering situations that standard policies often exclude, such as guest-related damages or liability claims. Whether you occasionally host short-term guests or run a dedicated rental, the right insurance ensures you’re prepared for unexpected challenges.

Understanding Home Sharing Insurance

Home sharing insurance is a specialized type of policy designed to address the unique needs of property owners and renters who participate in house sharing. It goes beyond standard insurance by offering coverage for risks specific to short-term rentals, ensuring that both hosts and their guests are adequately protected.

What Is Home Sharing Insurance

Home sharing insurance provides tailored coverage for property owners renting their homes or rooms for short-term stays. It bridges the gaps left by standard homeowners or renters insurance, often excluding damages or claims related to house sharing. This type of insurance typically includes coverage for liability, property damage, and even loss of income due to cancellations.

For example, if a guest accidentally breaks expensive appliances or injures themselves during their stay, your home sharing insurance policy ensures you won’t have to pay out of pocket for repairs or medical bills. It’s especially valuable for those using platforms like Airbnb or Vrbo, where such incidents are common.

Why Standard Policies Are Not Enough

Many property owners mistakenly believe their standard homeowners or renters insurance will cover them when renting their property. However, this assumption often leads to denied claims because most standard policies exclude coverage for commercial activities like short-term rentals. Renting out your home transforms it into a business requiring a policy specifically designed for such use. Here are some reasons why standard policies fall short:

- Exclusions for Commercial Use: Standard policies don’t cover damages or liability during paid stays.

- No Coverage for Guest Injuries: Your claim may be denied under a standard policy if a guest is injured on your property.

- Limited Property Protection: Damages caused by guests, such as broken furniture or vandalism, are often excluded.

Without home sharing or rent house insurance, you could face significant financial losses or legal challenges in these situations.

Coverage Options for Home Sharing Insurance

Selecting the right coverage is essential to protect you from the unique risks of house sharing. Unlike standard insurance policies, home sharing insurance provides options tailored to short-term rentals. Whether you are a homeowner or a renter, understanding the coverage options can help you make an informed decision.

What House Sharing Insurance Covers

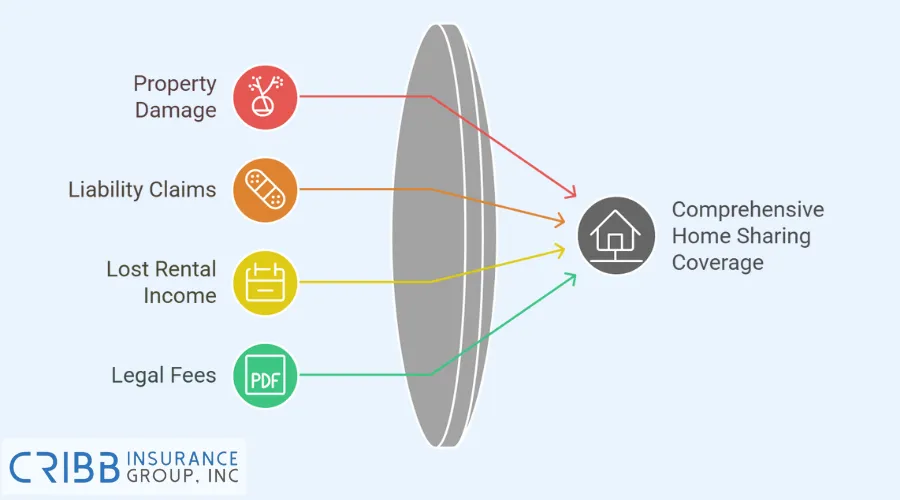

Home sharing insurance offers coverage that fills the gaps left by standard policies. These are the primary areas it typically covers:

- Property Damage: Covers repairs for damages caused by guests, such as broken furniture, appliances, or structural issues.

- Liability Claims: Protects if a guest gets injured on your property and decides to file a lawsuit or seek compensation for medical expenses.

- Lost Rental Income: Compensates you for income lost due to property damage that temporarily prevents you from renting out your home.

- Legal Fees: Covers costs associated with defending against lawsuits or disputes related to rental activities.

For example, if a guest accidentally starts a fire in your home or slips and falls on your property, home sharing insurance ensures you’re not left to handle these issues alone.

Comparing Policies for Homeowners and Renters

Home sharing insurance policies differ depending on whether you own the property or are renting it. Here’s how the coverage is tailored:

| For Homeowners | For Renters |

|---|---|

| Includes property coverage for the structure and its contents. | Focuses on liability protection if a guest gets injured or damages occur. |

| Offers liability protection for accidents or damages caused by guests. | Protects personal belongings but excludes the building structure. |

| May cover lost rental income in case of significant property damage. | Can include additional riders to address house sharing risks specific to renters. |

Understanding these differences allows homeowners and renters to choose the policy that best fits their needs and rental habits.

Risks of Renting Without Proper Insurance

Renting your home without proper insurance can expose you to significant risks that standard policies are unlikely to cover. Whether it’s property damage, guest injuries, or legal issues, not having home sharing insurance or rent house insurance could leave you with hefty out-of-pocket expenses.

Property Damage and Liability Risks

One of the most common challenges of house sharing is dealing with property damage caused by guests. These damages can be costly and stressful, from broken furniture to major structural repairs, without the right coverage. Standard policies often exclude these incidents because renting out your home is considered a commercial activity. Here are common property damage and liability risks:

- Guest-Induced Damage: Guests may accidentally or intentionally damage your property’s furniture, appliances, or other parts.

- Vandalism: Unruly tenants might cause intentional harm to the property, which homeowners insurance may not cover.

- Injuries on Your Property: If a guest slips, falls, or is injured in any way, you could be held liable for their medical expenses.

Without home sharing insurance, the cost of repairs, replacement, or liability claims will fall entirely on you. For example, if a guest accidentally starts a fire in the kitchen, you will face repair costs and may be responsible for liability claims if nearby properties are affected.

Financial Consequences of Being Uninsured

Operating without home sharing or rent house insurance could lead to significant financial burdens. Beyond immediate repair costs or legal fees, being uninsured can affect your ability to host in the future. These are the potential financial consequences:

- Repair and Replacement Costs: Covering damages caused by guests can run into thousands of dollars if uninsured.

- Lawsuit Settlements: Guest injuries or property disputes may result in lawsuits, with settlement costs far exceeding what most people can pay out of pocket.

- Lost Income: If your property is damaged and cannot be rented temporarily, you lose potential rental income.

- Higher Long-Term Costs: Having claims denied under a standard policy might force you to absorb the full financial impact of the incident.

For instance, if a guest is injured and sues you for negligence, the legal fees alone could be overwhelming. Proper insurance not only helps mitigate these risks but also gives you peace of mind while operating your rental.

How to Choose the Best Policy

Selecting the right home sharing insurance or rent house insurance policy is crucial to ensure that your property and finances are adequately protected. The best policy will depend on your rental habits, property type, and budget. By carefully evaluating your options, you can find coverage that fits your needs without overspending.

Factors to Consider When Choosing Coverage

When evaluating insurance options, it’s important to focus on your unique situation and the specific risks associated with house sharing. Here are the key factors to consider:

- Rental Frequency: Are you renting occasionally or operating as a full-time host? Frequent rentals may require more comprehensive coverage.

- Property Type: A shared space, vacation home, or primary residence will have different insurance needs. Ensure the policy matches your rental setup.

- Coverage Limits: Verify that the policy offers sufficient limits for property damage, liability claims, and lost rental income.

- Provider Reputation: Choose an insurer with strong reviews and experience in handling claims for house sharing or rental properties.

- Policy Exclusions: Understand what isn’t covered, such as wear and tear or specific property damage, so there are no surprises later.

Addressing these factors allows you to select a policy that balances affordability with comprehensive protection.

Tips for Reducing Premiums

While insurance is essential, there are strategies to manage costs without compromising coverage. Here are some tips to help you lower your premiums:

- Bundle Policies: Combine your home sharing insurance with other policies, such as auto or homeowners insurance, to receive discounts.

- Increase Your Deductible: Opt for a higher deductible to reduce monthly or annual premiums, but ensure you can afford the out-of-pocket costs if needed.

- Shop Around: Compare quotes from multiple providers to find the best rates and coverage options for your needs.

- Install Safety Features: Security cameras, smoke detectors, and other safety measures can lower liability risks and reduce premiums.

- Limit Risky Guests: Implement rules to avoid high-risk behaviors, like parties, which may increase claims.

These steps can make securing home sharing insurance or rent house insurance more cost-effective while still providing robust protection.

Protect Your Property with Cribb Insurance Group Inc

When it comes to protecting your property in Bentonville, AR, having the right insurance is essential. Cribb Insurance Group Inc offers tailored policies to ensure you’re covered against the risks of house sharing. Whether you’re a homeowner or a renter, having comprehensive protection means you can rent your space with confidence and peace of mind.

Choosing the right home sharing insurance is more than just a safety net; it’s a smart investment in your financial security. From liability coverage to protection against property damage, working with a trusted provider ensures you’re prepared for any challenges that come your way.

Frequently Asked Questions

Can I use homeowners insurance for short-term rentals?

Homeowners insurance typically does not cover short-term rentals because it considers these activities as commercial use. Renting out your home without proper home sharing insurance could leave you unprotected if damages or liability issues arise. It’s essential to have a policy tailored for short-term rentals to avoid denied claims.

What happens if a guest gets injured on my property?

If a guest is injured while staying on your property, you could be held liable for medical expenses or legal claims. Home sharing insurance provides liability protection to cover these costs, ensuring unexpected incidents do not financially burden you.

Are there specific policies for vacation rentals?

Yes, there are policies specifically designed for vacation rentals. These policies often cover property damage, liability, and loss of rental income, catering to the unique needs of short-term rentals. They ensure comprehensive protection for both owners and renters.

How do I find the best provider for house sharing insurance?

To find the best provider, research companies specializing in rental or house sharing insurance. Look for strong customer reviews, transparent policies, and customizable coverage options. Providers like Cribb Insurance Group Inc offer tailored solutions for property owners in Bentonville, AR.

Does house sharing insurance cover my personal belongings?

Yes, most home sharing insurance policies offer protection for personal belongings, but the extent of coverage depends on the policy. Ensure your provider includes this feature, especially if your rental property contains valuable items.

Get the Best Home Sharing Insurance in Bentonville, AR

Secure your property and peace of mind with Cribb Insurance Group Inc. Contact us today at (479) 286-1066 to discuss your coverage options for home sharing insurance. Protect yourself from risks and confidently manage your rental activities with a trusted provider.