Is life insurance a good investment? This question often arises when individuals evaluate their long-term financial goals. Life insurance can serve as both a protective measure and a potential investment tool, depending on the type of policy you choose. Understanding the benefits of investing in life insurance, along with its role in securing your family’s future, is key to determining if it aligns with your financial plans.

This article explores whether life insurance is a good investment for long-term goals, comparing its advantages, and limitations, and how it fits alongside other financial strategies. By the end, you’ll have a clear understanding of how life insurance can complement your financial journey.

Understanding the Types of Life Insurance Policies

Choosing the right type of life insurance depends on your needs and financial goals. There are two primary types of policies, each offering different benefits and drawbacks.

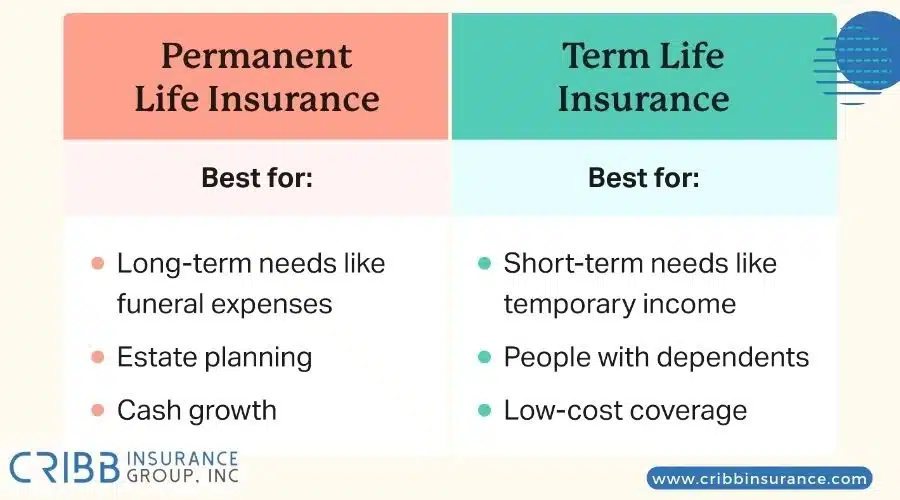

Differences Between Term and Permanent Insurance

Term and permanent life insurance serve different purposes. Term life insurance provides coverage for a set period, usually between 10 and 30 years. It’s affordable and ideal for those seeking temporary protection. If you outlive the term, the policy expires, and there’s no payout or cash value.

Permanent life insurance, on the other hand, lasts a lifetime as long as you pay premiums. It includes a cash value component that grows over time and can be used for major expenses. While permanent policies are more expensive, they can serve as both a protection plan and an investment tool.

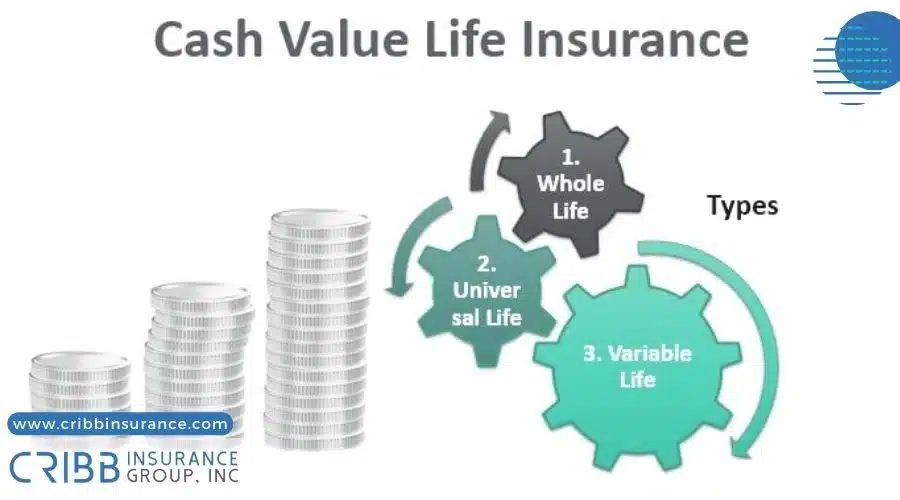

Unique Features of Whole Life and Universal Policies

Permanent policies come in various forms, with whole life and universal life being the most common. Whole life insurance offers fixed premiums and guaranteed cash value growth, making it predictable and stable. It’s ideal for those who want steady returns and reliable coverage.

Universal life insurance provides flexibility. You can adjust your premiums and death benefits as your needs change. It also offers cash value growth based on market rates, which can lead to higher returns or greater risk. Both options cater to different goals, so understanding their features is essential to make an informed choice.

What Makes Life Insurance a Smart Financial Choice

Life insurance is more than just a payout for your family. It’s a financial decision that can help you achieve specific long-term goals, depending on the type of policy you choose.

How Life Insurance Supports Long-Term Financial Goals

Life insurance policies with cash value can help fund retirement, pay for college, or cover emergency expenses. Permanent policies grow tax-deferred, meaning you won’t pay taxes on the earnings until you withdraw them. This makes them an effective tool for building wealth over time.

Additionally, life insurance provides financial security to your family by covering debts, mortgages, or living expenses. This ensures your loved ones won’t struggle financially in your absence, aligning with both short-term and long-term objectives.

Exploring Tax Benefits of Life Insurance Policies

Life insurance policies can offer significant tax advantages, making them a valuable addition to your financial strategy. These benefits can help you build wealth while reducing your overall tax burden. Here are the key tax-related benefits of life insurance:

- Tax-Free Death Benefit: The money your beneficiaries receive upon your passing is generally not subject to federal income taxes. This ensures your loved ones get the full value of the policy’s payout.

- Tax-Deferred Cash Value Growth: For permanent life insurance policies, the cash value grows on a tax-deferred basis. You don’t owe taxes on interest, dividends, or capital gains until you withdraw from the account.

- Tax-Free Policy Loans: If you borrow against the cash value of your life insurance policy, the loan is not taxed. This allows you to access funds without incurring additional tax liabilities, as long as the loan is repaid.

- No Required Minimum Distributions: Unlike retirement accounts like 401(k)s or IRAs, life insurance policies do not require you to withdraw money at a certain age, allowing your cash value to continue growing.

- Estate Tax Benefits: Properly structured life insurance policies can help reduce the taxable value of your estate, ensuring more of your wealth is passed on to heirs. This is especially beneficial for high-net-worth individuals engaged in estate planning.

When Life Insurance May Not Be the Best Investment

While life insurance offers many benefits, it may not always align with every financial goal or situation. Understanding when life insurance may not be the right investment can help you make a more informed decision.

Situations Where Term Life Insurance Works Better

Term life insurance is often the better choice for those with short-term needs or limited budgets. Here are scenarios where term policies excel:

Temporary Financial Obligations: If you have a mortgage or other debts that will be paid off in 10-30 years, a term policy provides affordable coverage during that period.

Dependents with Limited Reliance: Families with children nearing financial independence may find term insurance sufficient to cover education costs or other temporary expenses.

Budget-Friendly Protection: Term life insurance is significantly cheaper than permanent policies, making it ideal for individuals seeking cost-effective coverage.

No Need for Investment Features: If your primary goal is income replacement rather than building cash value, term insurance avoids the higher premiums of permanent policies.

Why Permanent Life Insurance May Not Suit Everyone

Permanent life insurance can be a valuable tool, but it’s not for everyone. Here’s why it may not fit certain financial plans:

- High Premiums: Permanent life insurance policies can be expensive. If your budget is tight, these higher costs might outweigh the benefits.

- Complex Investment Management: Policies like Universal Life require ongoing management of cash value and investment options, which can be confusing or burdensome for some.

- Limited Liquidity: The cash value takes years to grow significantly, making it less ideal if you need access to funds in the short term.

- Better Alternatives for Investing: If you’re already maxing out tax-advantaged accounts like 401(k)s or IRAs, you may achieve higher returns with traditional investments rather than through permanent life insurance.

- No Dependents or Minimal Debt: If you’re single, have no dependents, and your assets can cover your debts, the need for life insurance, particularly permanent policies, is reduced.

Life Insurance Compared to Other Financial Strategies

When considering whether life insurance is a good investment, it’s essential to compare it to other financial tools. Retirement accounts and emergency savings each serve specific purposes, and understanding their differences can help you prioritize effectively.

Evaluating Life Insurance Versus Retirement Accounts

Life insurance and retirement accounts, such as 401(k)s or IRAs, both offer financial security, but they operate differently. Here’s how they compare:

| Feature | Life Insurance | Retirement Accounts (e.g., 401(k), IRA) |

| Purpose | Primarily provides financial protection for beneficiaries; some policies include a cash value component for wealth building. | Designed for long-term saving and growth of funds to be used during retirement. |

| Tax Benefits | Tax-free death benefit; tax-deferred growth on cash value; tax-free loans available against cash value. | Contributions may be tax-deductible; growth is tax-deferred; withdrawals may be tax-free (Roth accounts). |

| Flexibility | Cash value can be borrowed or withdrawn (may reduce death benefit). | Subject to penalties for early withdrawals (before age 59½), except in certain circumstances. |

| Cost | Permanent policies require higher premiums; term policies are more affordable but lack cash value. | Contributions are more flexible, with lower management fees compared to permanent life insurance. |

| Growth Rate | Cash value grows more slowly, often at a fixed rate or based on market performance. | Investments typically grow faster with diversified portfolios in stocks, bonds, or mutual funds. |

| Contribution Limits | No set contribution limits for life insurance policies. | Annual contribution limits set by the IRS (e.g., $22,500 for 401(k) in 2024). |

For most people, retirement accounts should take priority due to their lower costs and higher growth potential. However, life insurance can act as a supplemental financial tool, providing additional security and benefits like tax-free death payouts.

Key Takeaways:

- Purpose: Life insurance focuses on protecting beneficiaries, while retirement accounts are designed for retirement savings and growth.

- Tax Benefits: Both offer tax advantages, but life insurance emphasizes tax-free death benefits, whereas retirement accounts focus on deferred or tax-free growth.

- Flexibility: Life insurance offers more immediate access to cash (with limitations), while retirement accounts have stricter rules for early withdrawals.

- Cost: Retirement accounts are more cost-effective for long-term growth; life insurance, especially permanent policies, can be significantly more expensiv

Life Insurance or Emergency Savings: What to Prioritize

Emergency savings and life insurance both serve critical purposes, but they address different financial needs. Here’s how to decide what to prioritize:

- Immediate Accessibility: Emergency savings are liquid and can be accessed immediately to cover unexpected expenses like medical bills or home repairs. Life insurance cash value, however, may take years to grow significantly and isn’t designed for urgent needs.

- Financial Protection: Life insurance ensures your family’s financial security in the event of your death. Emergency savings, meanwhile, protect you from financial instability during life’s unexpected events.

- Cost Considerations: Building an emergency fund requires no ongoing fees, aside from maintaining a savings account. Life insurance, particularly permanent policies, involves significant premiums that may strain your budget if you lack an emergency cushion.

- Recommended Priority: Financial experts recommend saving 3–6 months’ worth of expenses in an emergency fund before investing in life insurance with cash value. This ensures you have immediate resources for unforeseen circumstances while life insurance provides long-term security.

Strategies to Get the Most From Life Insurance

Life insurance can do more than just provide a death benefit. When used strategically, it can support significant financial goals and complement other investment strategies. Here are ways to maximize its value.

Using Cash Value for Retirement or Major Expenses

Permanent life insurance policies come with a cash value component that can grow over time. Here’s how you can use it effectively:

- Supplement Retirement Income: The cash value of a life insurance policy can be withdrawn or borrowed to support your retirement lifestyle. Since loans against the policy are generally tax-free, it can be an efficient way to access funds without triggering additional taxes.

- Fund Major Life Goals: Whether it’s paying for a child’s college tuition, making a down payment on a home, or covering medical expenses, the cash value can act as a financial resource. While withdrawals reduce the policy’s death benefit, they can be a flexible option in times of need.

- Emergency Financial Safety Net: In cases where traditional emergency savings aren’t enough, the cash value provides an additional layer of financial security. It’s essential, however, to monitor the policy carefully to avoid lapsing due to insufficient cash value.

Combining Life Insurance With a Balanced Portfolio

Life insurance can complement traditional investments to create a more comprehensive financial plan. Here’s how it fits into a diversified strategy:

- Risk Management: Life insurance provides guaranteed death benefits, offering a level of security that high-risk investments like stocks or mutual funds cannot. This makes it a steady foundation within a broader financial portfolio.

- Tax-Efficient Diversification: The tax advantages of life insurance can balance taxable investment accounts. For instance, using the policy’s cash value to cover certain expenses allows other investments to grow uninterrupted.

- Wealth Transfer Planning: Life insurance is particularly effective in estate planning. By passing on tax-free death benefits, it ensures your heirs receive more of your legacy compared to assets subject to estate taxes.

- Backup Liquidity: If markets experience a downturn, the cash value of a life insurance policy can serve as an alternative source of funds, preventing you from having to sell investments at a loss.

Combining life insurance with a well-rounded portfolio ensures both short-term flexibility and long-term stability.

Why Life Insurance Matters for Long-Term Goals

Life insurance is a powerful tool that combines protection with financial growth. Whether you’re securing your family’s future, planning for retirement, or building wealth, the right policy can support your goals. Cribb Insurance Group Inc offers guidance tailored to your needs, ensuring your life insurance fits seamlessly into your financial strategy.

For residents of Bentonville, AR, we’re here to help you navigate your options and maximize your policy’s value. By choosing a policy that aligns with your long-term goals, you can enjoy peace of mind knowing your financial future is secure.

Frequently Asked Questions

How does life insurance fit into estate planning?

Life insurance plays a key role in estate planning by providing tax-free death benefits to beneficiaries. It ensures your loved ones receive financial support while helping to cover estate taxes, debts, or final expenses. For high-net-worth individuals, it’s an effective tool to preserve wealth for heirs.

Can life insurance be used to fund higher education?

Yes, the cash value of permanent life insurance can be withdrawn or borrowed to help pay for college tuition or other education-related expenses. This option offers flexibility without relying on student loans, although it’s essential to consider how withdrawals may reduce the policy’s death benefit.

What happens if I stop paying my premiums?

If you stop paying premiums, term life insurance will lapse, and coverage will end. For permanent policies, the insurer may use the cash value to cover payments temporarily, but if the cash value depletes, the policy may also lapse. Always review your options with your insurer to avoid losing coverage.

Are there penalties for withdrawing cash value?

Withdrawals up to the amount of premiums paid are typically tax-free, but exceeding this amount may result in taxable income. Additionally, withdrawing or borrowing from the cash value can reduce the death benefit or cause the policy to lapse if not managed properly.

How can I calculate the amount of life insurance I need?

Use the DIME method, which considers your debts, income replacement needs, mortgage, and education costs for dependents. Subtract existing savings or other insurance policies to determine the right amount. Consulting a financial advisor ensures your coverage aligns with your financial goals.

Get Expert Help With Life Insurance Today

Cribb Insurance Group Inc is dedicated to helping Bentonville, AR residents find the best life insurance options. Call us today at (479) 286-1066 to discuss your goals and secure a policy that works for you. Let us help you make life insurance a smart investment for your future.