Life insurance riders are optional features that allow you to customize your policy to fit your unique needs. These riders add flexibility and additional benefits, making your life insurance coverage more comprehensive. By adding an insurance rider, you can address specific situations such as critical illnesses, long-term care, or other unexpected events. Understanding how riders work and their potential advantages can help you create a policy that provides better financial security for you and your family.

What Are Insurance Riders

Insurance riders are designed to help you personalize your insurance policy, allowing you to address specific needs that a standard plan might not cover. These add-ons are ideal for individuals seeking tailored solutions for their unique circumstances. This section will explain what insurance riders are and why they’re essential for maximizing your policy’s potential.

Definition of Insurance Riders

An insurance rider is an optional provision that you can add to your life insurance policy to expand or modify its terms. Riders provide specific benefits not included in a basic insurance plan, allowing you to enhance your coverage. For example, a waiver of premium rider can help you maintain your policy without paying premiums if you become disabled.

The flexibility of life insurance riders allows you to adjust your coverage as your needs change over time, such as adding a rider for long-term care in your later years or a child rider for young dependents.

Key Features That Make Riders Essential

Insurance riders stand out for their ability to provide customized solutions. Here are the key features that make them an essential part of any life insurance policy:

- Flexibility: Riders allow you to tailor your insurance policy to meet specific needs, such as coverage for critical illnesses or accidental death.

- Additional Security: Riders offer extra protection that may not be included in a basic life insurance plan, like income support for your family in case of disability.

- Cost Efficiency: Adding a rider is often more affordable than purchasing separate insurance policies for additional coverage.

- Adaptability: Riders can address changing life circumstances, such as the need for more coverage as your family grows.

By understanding and leveraging the benefits of life insurance riders and insurance riders, you can ensure your policy works harder to provide the protection and flexibility you need.

Common Types of Insurance Riders

Insurance riders come in many forms, each designed to address specific risks and needs. Whether you’re looking to protect your health, your family, or your financial future, there’s a rider that can enhance your policy’s coverage. Understanding these common types can help you select the options that align with your goals.

Health-Related Riders and Their Benefits

Health-related riders provide financial protection during unexpected medical situations. These riders ensure you and your loved ones have support during difficult times. Common health-related riders include:

- Critical Illness Rider: Offers access to a portion of your death benefit if you’re diagnosed with a severe illness such as cancer, heart disease, or stroke.

- Long-Term Care Rider: Covers expenses related to long-term care, such as nursing home or in-home care, helping you avoid depleting savings.

- Accelerated Death Benefit Rider: Allows you to claim part of your death benefit if diagnosed with a terminal illness, ensuring financial relief while you’re still alive.

These riders can prevent financial strain during health crises, but it’s essential to understand each insurer’s terms and conditions, as coverage may vary significantly.

Family-Focused Riders for Spouses and Children

Family-focused riders are designed to provide additional coverage for your loved ones, offering peace of mind and financial stability. Popular options include:

- Child Rider: Adds coverage for your child, offering a small death benefit to help with funeral expenses or medical costs in case of a tragic event.

- Spouse Rider: Extends coverage to your spouse under the same policy, ensuring financial protection for your family.

- Family Income Rider: Provides a monthly income to your family in the event of your passing, supplementing the death benefit and ensuring financial stability.

These riders are particularly useful for families seeking comprehensive coverage under one policy, simplifying management and reducing overall costs.

Policy Enhancement Riders to Maximize Coverage

Policy enhancement riders are ideal for those looking to expand their coverage or adapt it to changing needs. These options add flexibility and value to your policy:

- Guaranteed Insurability Rider: This lets you increase your coverage amount at specific intervals without undergoing a medical exam, which is helpful as your financial responsibilities grow.

- Return of Premium Rider: Refunds all or part of the premiums paid if the policyholder outlives the policy term, offering financial value even without a claim.

- Cost of Living Rider: Adjusts your death benefit over time to keep up with inflation, ensuring your coverage maintains its value.

These riders provide options for policyholders who want to maximize their investment in life insurance and adapt their coverage over time.

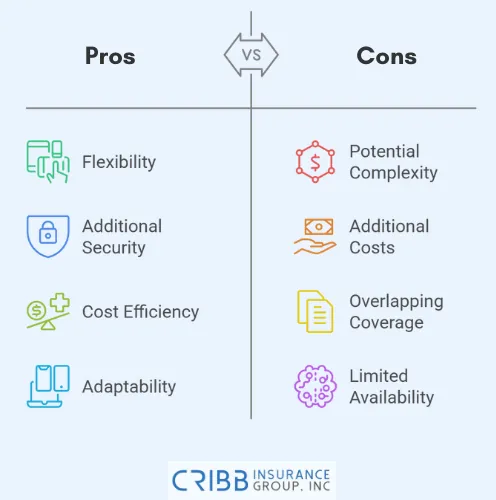

Benefits of Adding Riders to Life Insurance

Adding riders to your life insurance policy can transform basic coverage into a plan tailored to your needs. Riders provide flexibility, security, and financial efficiency, making them a valuable addition for many policyholders. Let’s explore how riders enhance your policy and evaluate their overall value.

How Riders Provide Flexibility and Security

Life insurance riders allow you to adapt your policy to changing circumstances, offering peace of mind and added protection for unexpected situations. Here’s how riders contribute to flexibility and security:

- Address Unique Needs: Riders let you customize coverage to protect against specific risks, such as critical illnesses or long-term care needs.

- Ensure Financial Stability: Riders like the family income rider or waiver of premium rider ensure continued financial support in case of disability, illness, or death.

- Adapt Over Time: Riders like the guaranteed insurability rider allow you to increase coverage as your financial responsibilities grow, without requiring additional medical exams.

- Protect Loved Ones: Family-focused riders offer direct support for your spouse or children, ensuring financial stability for your dependents.

This flexibility ensures your life insurance policy evolves with your needs, providing more comprehensive coverage than a standard plan.

Cost-Benefit Analysis of Popular Riders

While riders can enhance your policy, assessing whether the added benefits justify the cost is important. Here’s a closer look at the value they offer:

| Rider Type | Pros | Cons |

|---|---|---|

| Critical Illness Rider | – Provides financial support for treatment of severe illnesses like cancer or stroke. – Offers access to a portion of the death benefit during critical illness. | – Increases premium costs significantly.

– Coverage may exclude pre-existing conditions or specific illnesses. |

| Long-Term Care Rider | – Covers caregiving expenses like nursing home or in-home care.

– Protects retirement savings from being depleted by healthcare costs. | – May have age-related restrictions for eligibility.

– Can be expensive depending on the level of care coverage. |

| Waiver of Premium Rider | – Ensures policy coverage continues if you’re unable to work due to disability.

– Helps prevent lapses in coverage during financial hardship. | – Requires detailed disability documentation to activate.

– Adds a small cost to your premiums. |

| Child Rider | – Affordable option to provide coverage for children.

– Offers financial support for medical bills or funeral expenses. | – Smaller payout compared to other riders.

– Coverage is limited to the child’s age or policy terms. |

When choosing riders, compare the premium increase to the potential benefits and consider your financial situation, life stage, and long-term goals. This evaluation helps ensure you’re maximizing the value of your life insurance policy.

How to Choose the Right Insurance Rider

Selecting the right insurance rider can significantly enhance your policy’s value and provide tailored coverage for your needs. With various options available, evaluating your goals and understanding the factors influencing your decision is essential. This section provides a framework to help you make an informed choice.

Questions to Ask Before Selecting Riders

Before adding a rider to your life insurance policy, asking the right questions is important to ensure it aligns with your needs. Here are some key questions to guide your decision:

- What Risks Do I Want to Cover?: Identify the specific risks or scenarios you’re concerned about, such as critical illness, disability, or providing for family members.

- How Will This Rider Impact My Premiums?: Understand the cost of adding the rider and how it affects the overall affordability of your policy.

- Are There Any Restrictions or Exclusions?: Review the fine print to ensure the rider covers your intended needs without unexpected limitations.

- Can This Rider Be Added Later?: Some riders must be included at the time of purchase, while others can be added later as your needs evolve.

- Is This Rider Worth the Cost for My Situation?: Evaluate whether the added benefits justify the increase in premiums based on your financial priorities.

Asking these questions helps you avoid unnecessary costs and ensures the riders you choose add meaningful value to your coverage.

Matching Riders to Your Financial Goals

The right insurance rider should complement your overall financial strategy and provide support during life’s uncertainties. Here’s how to match riders to your financial goals:

- Protect Against Income Loss: Add a waiver of premium rider or family income rider to ensure financial stability for your loved ones in case of disability or death.

- Plan for Long-Term Care Needs: Consider a long-term care rider to address potential medical or caregiving expenses later in life, reducing the strain on retirement savings.

- Secure Future Coverage Needs: Use a guaranteed insurability rider to increase your coverage without additional medical exams as your financial responsibilities grow, such as starting a family or purchasing a home.

- Provide for Loved Ones: Add child and spouse riders to include coverage for dependents, ensuring their financial needs are met.

- Enhance Policy Value: Riders like the return of premium rider allow you to recoup your investment if the policy is not claimed, providing additional financial security.

By aligning your rider choices with your financial goals, you can create a life insurance policy that evolves with your needs and ensures long-term security.

Mistakes to Avoid When Adding Riders

While life insurance riders can enhance your policy, common mistakes can reduce their effectiveness or lead to unnecessary expenses. Understanding these pitfalls ensures that your riders work as intended and provide maximum value.

Ignoring the Fine Print and Policy Exclusions

One of the most frequent mistakes when adding riders is failing to review the terms and conditions carefully. Each insurance rider has unique rules and limitations that can affect how and when benefits are paid. Here are key areas to pay attention to:

- Exclusions: Some riders exclude specific conditions or circumstances. For example, a critical illness rider might only cover certain diseases or exclude pre-existing conditions.

- Usage Limits: Many riders, such as accelerated death benefit riders, have restrictions on how often or under what conditions they can be used.

- Expiration Clauses: Some riders have time limits or cease to provide benefits once the policyholder reaches a certain age.

- Claim Requirements: Riders like the waiver of premium rider often require detailed documentation to activate benefits, such as proof of disability.

By thoroughly reviewing the fine print, you can avoid unpleasant surprises and ensure the rider meets your expectations when you need it most.

Choosing Riders That Don’t Suit Your Needs

Another common mistake is selecting riders that do not align with your personal or financial goals. This can lead to unnecessary costs or inadequate coverage. To avoid this, consider the following:

- Overestimating Coverage Needs: Adding too many riders can inflate premiums without providing meaningful benefits. Focus on the riders that address your primary concerns.

- Overlooking Current Coverage: If your base policy already includes certain features, such as built-in terminal illness benefits, you may not need an additional rider for the same purpose.

- Failing to Anticipate Future Changes: Your financial needs and life circumstances may evolve. Riders like the guaranteed insurability rider are particularly helpful for adapting coverage over time.

- Prioritizing Unnecessary Riders: Avoid adding riders simply because they sound appealing. For example, a return of a premium rider might not be cost-effective if you don’t anticipate keeping the policy for its full term.

Carefully assess your current and future needs to ensure the riders you choose provide meaningful benefits while remaining cost-effective.

Maximize Your Life Insurance Policy With Cribb Insurance Group Inc

Life insurance riders can transform a standard policy into one that meets your specific needs, providing flexibility, security, and peace of mind. You can enhance your financial protection by understanding the types of riders available and carefully selecting the ones that align with your goals.

At Cribb Insurance Group Inc, we specialize in helping individuals and families in Bentonville, AR, create personalized life insurance plans. Whether you need to add critical illness coverage or ensure your family’s financial security, our team guides you every step of the way.

Frequently Asked Questions

What is the role of a financial advisor in choosing riders?

A financial advisor can help you understand which insurance riders align with your current and future financial goals. They assess your unique circumstances, such as income, family needs, and risk tolerance, to recommend riders that provide the most value for your policy. Consulting an advisor ensures informed decisions tailored to your situation.

Can I add riders to an existing insurance policy?

In most cases, riders must be added when purchasing your policy. However, some insurance companies allow specific riders, like a long-term care rider, to be added later. It’s best to check with your insurer about the eligibility and requirements for adding riders to an active policy.

How do riders impact my premiums over time?

Adding riders typically increases your premiums, but the amount depends on the rider’s coverage and your policy type. Some riders, like a return of premium rider, might offer financial benefits that offset the extra cost, while others, such as a waiver of premium rider, provide long-term protection at a small price increase.

Are riders available for all types of insurance?

Not all insurance policies offer riders, and the availability of specific riders varies by provider. Life insurance policies, for instance, commonly include riders like critical illness or family income riders. It’s important to discuss your needs with your insurance company to see what options are available for your policy type.

What happens if I don’t use my rider benefits?

If you don’t use a rider’s benefits, you won’t receive a refund for the extra premiums paid, unless it’s a return of a premium rider. Unused riders typically expire when the policy ends or when their specific term conditions are no longer applicable, such as reaching a certain age.

Take the Next Step Toward Better Coverage

Enhance your life insurance policy today with the right riders to protect your future. Contact Cribb Insurance Group Inc at (479) 273-0900 to explore your options and create a plan that fits your needs. Secure peace of mind for yourself and your family in Bentonville, AR.