The hidden benefits of bundling home and auto insurance can help you save money and simplify your financial planning. By combining these two essential policies under one provider, you can enjoy multi-policy discounts, easier policy management, and other perks. The benefits of bundling home and auto insurance don’t stop at affordability; this approach also offers convenience and potential upgrades in coverage. This article will explore everything you need to know about bundling, including how it works, why it’s beneficial, and how to decide if it’s right for you.

What Is Bundling Home And Auto Insurance

Bundling home and auto insurance means combining your home and car policies with a single insurance company. It’s a popular way to save money and simplify managing your insurance needs. Many companies offer multi-policy discounts, which make this option appealing to homeowners and drivers. Aside from saving money, the benefits of bundling insurance include streamlined policy management and exclusive perks.

Simple Explanation Of Insurance Bundling

Bundling insurance is straightforward: it involves purchasing two or more types of insurance, such as home and auto policies, from the same provider. Many insurers encourage this by offering discounts for bundled policies, making it an attractive option for cost-conscious consumers. Here are the key points to know about bundling:

- Discounts: Most companies provide a price reduction for combining policies, typically ranging from 10% to 25%.

- Single Provider: You work with one company, which simplifies billing, customer service, and claims.

- Combined Deductibles: Some insurers allow you to pay just one deductible if the same event (like a natural disaster) affects both your home and car.

By bundling, you not only save money but also enjoy easier policy management and access to potential upgrades in coverage. It’s a practical choice for those looking for a cost-effective and efficient approach to their insurance needs.

Top Benefits Of Bundling Home And Auto Insurance

Bundling home and auto insurance offers several advantages that go beyond just saving money. It simplifies how you manage your policies and often provides extra perks not available to standalone plans. Understanding these benefits can help you decide if bundling is the right option for your insurance needs.

Saving Money With Discounts

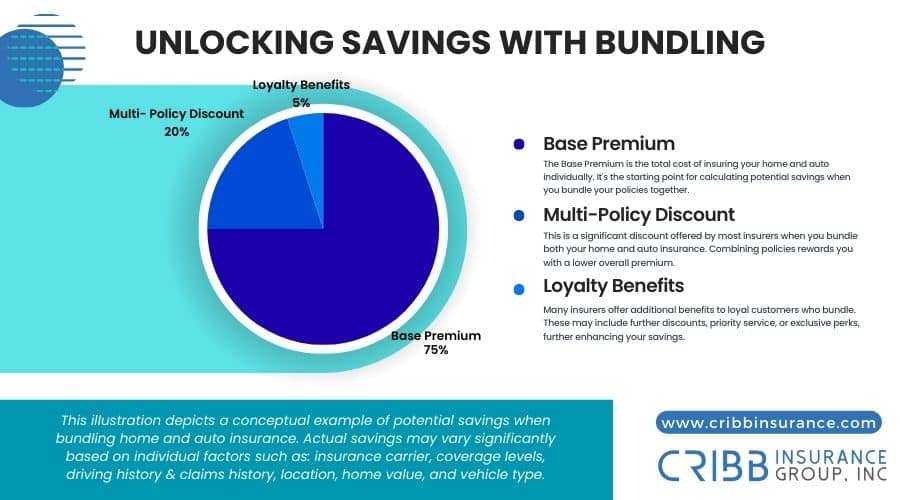

One of the most significant benefits of bundling home and auto insurance is the cost savings. When you bundle, most insurers provide a multi-policy discount, which can range from 10% to 25%. Here are the key points to know about saving money with bundling:

- Multi-Policy Discounts: These discounts apply directly to your premium, lowering the overall cost of insuring your home and car.

- Loyalty Benefits: Many insurers offer additional discounts for long-term customers who choose to bundle.

- Combined Billing Savings: Some providers waive administrative fees for customers who bundle, further reducing costs.

For example, if your total insurance premium is $5,000 annually, bundling could save you up to $1,250. This makes bundling a practical choice for homeowners and drivers looking to lower their insurance expenses without sacrificing coverage.

Simplified Policy Management

Bundling doesn’t just save money, it also simplifies how you manage your insurance policies. Having a single provider for both home and auto coverage reduces the complexity of juggling multiple insurers. Here are the key points to know about simplified management:

- Unified Billing: You’ll receive one consolidated bill instead of separate ones for home and auto policies.

- Streamlined Customer Service: Whether you’re filing a claim, updating your coverage, or asking a question, you’ll only need to contact one company.

- Easier Claims Process: In the event of a disaster affecting both your home and car, you only need to work with one insurer to handle both claims.

This convenience is particularly beneficial for busy individuals and families who value simplicity in their financial planning.

Additional Perks And Enhanced Coverage

Bundling home and auto insurance can also provide exclusive perks and coverage upgrades. Insurers often reward bundled customers with benefits that aren’t available to those with standalone policies. Here are the key points to know about the perks:

- Enhanced Liability Limits: Bundled policies may include higher liability coverage, protecting you more effectively in case of accidents or lawsuits.

- Special Coverage Options: Some providers offer unique add-ons, such as coverage for valuables or roadside assistance, as part of a bundled plan.

- Loyalty Rewards: Insurers often extend loyalty benefits to customers who maintain bundled policies over several years.

These perks not only increase the value of your insurance but also make bundling an attractive option for anyone looking to maximize their coverage.

Who Benefits Most From Bundling Home And Auto Insurance

Bundling home and auto insurance isn’t for everyone, but it can be an excellent choice for many. Understanding who benefits most from this approach can help you determine if it’s the right decision for you. Whether you’re a homeowner, a driver, or someone managing multiple policies, bundling can offer unique advantages depending on your circumstances.

Ideal Candidates For Bundling

Certain groups of people tend to benefit the most from bundling home and auto insurance. Here are the key points to know about who should consider bundling:

- Homeowners With Vehicles: Bundling is ideal for individuals who own a home and one or more vehicles. Combining these policies often leads to significant savings and simplified management.

- Families With Multiple Policies: Families insuring multiple vehicles or properties can maximize discounts and streamline billing by bundling.

- Long-Term Insurance Customers: Those planning to stick with one insurer for years often gain loyalty rewards and enjoy consistent premium rates.

- Budget-Conscious Shoppers: People looking for a cost-effective way to protect their assets can benefit from the discounts and perks bundling provides.

If you fit into one of these categories, bundling home and auto insurance could simplify your financial planning and help you save money.

Scenarios Where Bundling May Not Be The Best Choice

While bundling has many advantages, it’s not always the best option for everyone. Here are the key points to consider when bundling might not work well for you:

- Uncompetitive Rates: If one of the policies, home or auto, has a higher-than-average premium, bundling might not lead to real savings.

- Limited Coverage Needs: Renters or individuals with basic car insurance might find standalone policies more affordable or flexible.

- Specialized Insurance Needs: Those requiring unique coverage, such as high-value home insurance or specialty car insurance, may not find suitable options within a bundle.

- Frequent Policy Changes: If you frequently switch providers for better rates, bundling may not be worth the effort, as it often involves cancelation fees or loss of discounts.

By carefully evaluating your specific needs and comparing standalone policies with bundled options, you can determine whether bundling aligns with your financial goals and coverage requirements.

How To Start Bundling Home And Auto Insurance

Starting the process of bundling home and auto insurance is straightforward, but it requires a little preparation to ensure you get the best deal. Taking the time to review your existing policies and compare options from multiple providers can lead to significant savings and better coverage. This section outlines the essential steps to help you start bundling with confidence.

Reviewing Current Policies And Coverage Needs

The first step in bundling home and auto insurance is understanding your current policies and coverage requirements. Here are the key points to consider:

- Assess Your Current Policies: Review the terms, premiums, deductibles, and coverage limits of your existing home and auto insurance. Identify gaps or overlaps in coverage.

- Evaluate Your Insurance Needs: Consider factors like the value of your home, the age and condition of your vehicle, and any additional coverage needs (e.g., flood insurance or roadside assistance).

- Make A List Of Priorities: Determine what’s most important to you, whether it’s saving money, simplifying policy management, or enhancing coverage.

Taking this step ensures you know exactly what you need before you start shopping for bundled policies, helping you avoid unnecessary coverage or hidden costs.

Comparing Quotes And Finding The Best Bundle

Once you have a clear picture of your coverage needs, the next step is to shop around for the best bundle. Comparing quotes from multiple insurers will help you find a package that fits your budget and provides adequate protection. Here are the steps to follow:

- Gather Quotes From Multiple Providers: Request quotes from at least three reputable insurance companies that offer home and auto bundles.

- Compare Coverage Options: Look beyond the price. Ensure each bundle meets your coverage needs, and check for additional perks like unified deductibles or loyalty discounts.

- Ask About Discounts: Inquire about specific discounts for bundling, such as savings for safe driving, installing home security systems, or being a long-term customer.

- Check Customer Reviews: Research the company’s reputation for customer service, claims handling, and policy flexibility.

- Read The Fine Print: Ensure you understand any exclusions, limits, or conditions tied to the bundle.

By comparing options carefully, you can find a bundle that saves you money and provides the coverage you need, all while simplifying your policy management.

Potential Drawbacks Of Bundling Insurance

While bundling home and auto insurance offers many advantages, it’s important to understand the potential downsides. Knowing these drawbacks helps you make an informed decision and avoid surprises that could outweigh the benefits.

Premium Increases Over Time

One common drawback of bundling insurance is that premiums can gradually increase over time. Insurers often attract new customers with competitive discounts, but as years go by, they may raise rates for bundled policies. This happens because many customers find it inconvenient to switch providers, and insurers rely on this tendency to retain policyholders despite higher prices. Additionally, bundling may create a sense of loyalty that discourages customers from shopping around for better rates. To avoid overpaying, it’s crucial to review your bundled policies annually, compare quotes from competitors, and negotiate with your current insurer for better terms.

Coverage Gaps And Limitations To Watch For

While bundling can simplify your insurance needs, it’s essential to ensure that your coverage remains comprehensive. Here are the key points to consider about potential coverage gaps:

- Policy Limitations: Some bundled packages may not include specific coverage types, such as flood insurance or high-value item protection.

- Overlap Risks: If not reviewed carefully, bundling can result in overlapping coverage that may inflate your premium unnecessarily.

- Custom Coverage Needs: Individuals requiring specialized insurance, like classic car coverage or additional property protection, may find bundled plans too generalized to meet their needs.

Always read the fine print of your policies and confirm that your bundled package addresses all potential risks specific to your home and vehicle.

Why Cribb Insurance Group Inc Is Your Trusted Choice For Bundling

Bundling your home and auto insurance offers significant savings and convenience, but finding the right provider makes all the difference. At Cribb Insurance Group Inc, we’re committed to helping Bentonville, AR residents make the most of their insurance options. Our expertise ensures you get the right coverage tailored to your needs, without the hassle of managing multiple providers.

By bundling your policies with us, you can enjoy multi-policy discounts, simplified claims processing, and exclusive perks designed for long-term value. Whether you’re new to bundling or looking to switch providers, we’re here to help you navigate your options and save money.

Frequently Asked Questions

What types of coverage are typically excluded from bundling?

Specialized insurance, such as flood coverage, earthquake insurance, or classic car policies, is often excluded from standard bundling options. These types of coverage usually require separate policies or add-ons, so it’s important to confirm what’s included in your bundle before signing up.

Does bundling impact claims processing times?

Bundling typically simplifies claims processing since you deal with one provider for both home and auto claims. However, the time taken to process claims depends on the insurer’s efficiency. Choosing a reputable company ensures smoother claims handling for bundled policies.

Can I switch providers while keeping my bundled discount?

No, bundled discounts are tied to the provider offering the policies. If you switch insurers, you’ll need to establish a new bundle with your new provider to maintain the discounts. Be sure to compare quotes before making the switch.

Are there any loyalty programs tied to bundled policies?

Many insurers reward long-term customers with loyalty benefits, such as additional discounts or enhanced coverage. Bundling often qualifies you for these programs, making it advantageous to maintain your policies with the same provider over time.

How does bundling affect deductible options for claims?

Some insurers offer combined deductibles for bundled policies. This means you only pay one deductible if the same event, like a storm, damages both your home and car. Be sure to confirm this benefit with your provider when bundling.

Simplify Your Insurance With Cribb Insurance Group Inc

Ready to bundle and save? Call Cribb Insurance Group Inc today at (479) 273-0900 to explore your options. Our Bentonville, AR team is here to find the best bundle for your needs. Let us help you protect your home and car while keeping your insurance simple and affordable.