Understanding the types of car insurance coverage is essential for making informed decisions about protecting your vehicle, passengers, and finances. The right coverage ensures you’re prepared for unexpected events and can meet your state’s legal requirements. This guide breaks down the various types of car insurance to help you select the policies that suit your needs while avoiding unnecessary costs.

Understanding the Types of Car Insurance

Choosing the right types of car insurance coverage can be challenging with so many options available. Knowing what each type covers will help you select policies that provide adequate protection and meet your state’s requirements. Below, we explain the most common types of car insurance and their benefits.

Overview of Essential Car Insurance Types

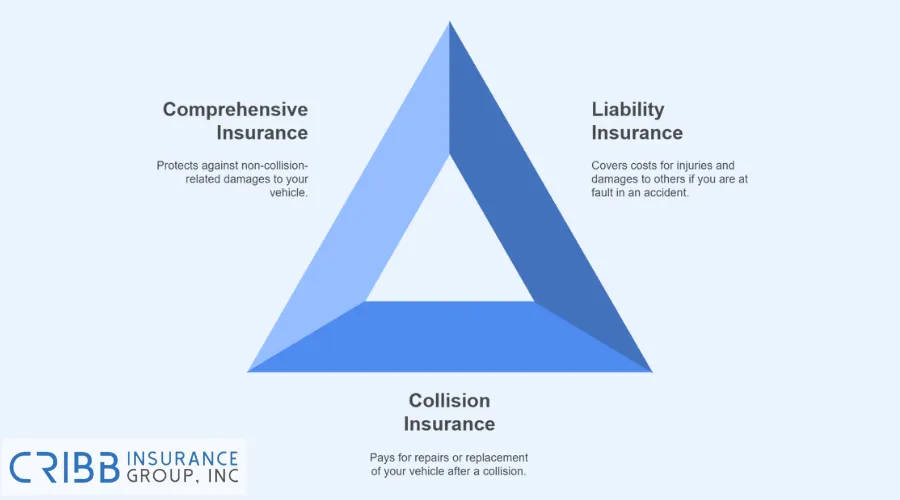

Three main types of car insurance are considered essential for protecting drivers and vehicles:

- Liability Insurance: Covers costs if you are at fault in an accident. It pays for injuries to other people and damage to their property, such as medical bills, lost wages, vehicle repairs, or other property damage. Liability insurance is mandatory in almost every state.

- Collision Insurance: Pays for repairing or replacing your vehicle if you’re involved in a collision, whether with another car or an object like a tree or fence. Lenders often require collision coverage for leased or financed vehicles.

- Comprehensive Insurance: Protects non-collision-related damages to your vehicle. It covers losses from theft, vandalism, natural disasters, or incidents like a tree branch falling on your car. Comprehensive insurance is optional but is commonly required by lenders for leased or financed cars.

Understanding these essential coverages ensures you meet legal requirements while protecting yourself from significant financial risks.

State Requirements for Car Insurance

Car insurance requirements differ from state to state, but most have specific minimum coverage standards drivers must meet. Understanding your state’s requirements ensures you comply with the law and have the protection you need. Below, we discuss the mandatory and optional car insurance coverages across different states.

What Car Insurance Is Mandatory

Mandatory car insurance ensures that drivers take financial responsibility for accidents they may cause. The following coverages are typically required by law:

- Liability Insurance: Nearly every state requires liability insurance, which covers costs related to injuries or property damage you cause to others in an accident. The minimum limits vary, with some states mandating higher coverage amounts than others.

- Uninsured/Underinsured Motorist Coverage: Some states require this coverage to protect you if you’re hit by a driver who lacks adequate insurance. It helps pay for medical expenses, lost wages, and other costs resulting from the accident.

Meeting these mandatory requirements keeps you legally compliant and protects you financially in case of an accident. Always check your state’s specific limits and requirements to ensure sufficient coverage.

Optional Insurance Rules by State

In addition to mandatory coverage, some states require certain optional policies, depending on the region’s laws and accident trends. These include:

- Personal Injury Protection (PIP): Common in no-fault states, PIP covers medical expenses, lost wages, and related costs, regardless of who is at fault in an accident.

- Medical Payments Coverage: While optional in many states, some require this coverage to help pay for medical bills for you and your passengers after an accident.

Optional rules allow flexibility in tailoring your policy but may vary depending on your state. For example, some states with high accident rates strongly recommend uninsured motorist coverage, while others focus on no-fault insurance options like PIP.

Choosing the Best Coverage for Your Needs

Choosing car insurance is key to finding the right balance between affordability and protection. With so many options available, evaluating your unique circumstances is important to determine which coverage types are essential and which may be unnecessary.

Factors to Consider When Selecting Coverage

Several factors influence the type and amount of car insurance you should purchase. Taking these into account ensures your policy aligns with your needs and budget:

- Vehicle Type and Age: Your car’s value and age play a big role in determining the necessary coverage. For example, newer or leased vehicles often require comprehensive collision coverage, while older cars with lower market value may not justify these policies.

- Driving Habits and Location: Where and how you drive affects your risk profile. High-traffic urban areas may require additional coverage to account for increased accident risks, while rural areas might not need the same level of protection.

- Budget: Balancing the cost of premiums with adequate coverage is crucial. Higher deductibles can reduce monthly payments, but you’ll need to ensure you can afford the out-of-pocket costs in case of a claim.

- State Requirements: Review your state’s minimum insurance requirements and build on them to suit your personal needs. For example, some states mandate liability insurance, but adding uninsured motorist coverage can provide extra security.

Considering these factors, you can customize a policy that protects your finances while ensuring you meet legal obligations.

Common Mistakes When Buying Insurance

Purchasing car insurance can be overwhelming, and common mistakes may leave you underinsured or overpaying for unnecessary coverage. Avoiding these errors will help you make better decisions:

- Overlooking State Laws: Failing to comply with state-mandated requirements can lead to fines, license suspension, or even denied claims in case of an accident. Always verify your state’s minimum coverage limits before finalizing your policy.

- Skipping Optional Coverage: Some drivers forego optional coverage like uninsured motorists or personal injury protection to save money, only to face significant out-of-pocket costs later. Evaluate optional policies carefully to ensure you’re not left vulnerable.

- Choosing the Cheapest Policy: While affordability is important, the cheapest option isn’t always the best. Inadequate coverage could cost you more in the long run, especially in the case of a major accident.

- Not Shopping Around: Insurance premiums can vary greatly between providers. Failing to compare quotes and coverage options may mean missing out on better rates or more comprehensive policies.

By avoiding these mistakes and planning carefully, you’ll secure a policy that provides the protection you need without unnecessary expenses.

Benefits of Optional Car Insurance Coverage

Optional car insurance coverage allows you to customize your policy to fit your needs better. These add-ons provide enhanced protection for specific situations, offering peace of mind in circumstances where basic coverage might fall short.

Enhancing Protection with Optional Coverages

Optional coverages can protect you in ways that standard policies don’t. Here are some of the most useful options and how they enhance your overall protection:

- Gap Insurance: If your vehicle is totaled and you owe more on the loan or lease than its current value, gap insurance covers the difference. This is particularly helpful for new or financed cars that depreciate quickly.

- Rental Reimbursement: If your car is being repaired after a covered accident, rental reimbursement helps pay for a temporary rental vehicle, keeping you on the road without added costs.

- Roadside Assistance: This coverage ensures you’re not stranded if your car breaks down. It can include services like towing, battery replacement, or help with a flat tire.

- Ride-Sharing Coverage: For those driving for companies like Uber or Lyft, this option bridges the gap between your policy and the coverage provided by the ride-share company, ensuring comprehensive protection during work hours.

Adding these coverages helps mitigate the financial burden of unexpected events, offering tailored solutions for specific needs.

How to Save on Optional Add-Ons

While optional coverages can add value, they also increase your premiums. Here are ways to save without sacrificing important protections:

- Bundle Policies: Many insurance providers offer discounts when combining policies, such as auto and home insurance, or adding multiple vehicles under one policy.

- Ask About Discounts: Insurers often provide discounts for factors like good driving records, completing defensive driving courses, or installing safety features in your car.

- Compare Providers: Premiums for optional coverages vary significantly between companies. Shop around to find providers offering the best coverage and cost balance.

- Evaluate Your Needs Regularly: If you’ve paid off your vehicle loan or no longer use your car for specific purposes like ride-sharing, reevaluating your coverage can help reduce unnecessary costs.

By carefully selecting and managing optional coverages, you can enhance your protection while keeping premiums affordable.

Choose the Right Insurance for Your Car

Choosing the right car insurance protects you from financial setbacks while meeting state requirements. At Cribb Insurance Group Inc, we’re dedicated to helping drivers in Bentonville, AR, find policies tailored to their needs. From understanding state-mandated coverage to exploring optional add-ons, we simplify the process to give you peace of mind on the road.

Our team takes pride in offering expert advice and personalized support. Whether you’re navigating options like liability, collision, or comprehensive coverage or need help with optional policies such as gap insurance or roadside assistance, we’re here to guide you every step of the way.

Frequently Asked Questions

What does full coverage car insurance include?

Full coverage car insurance typically combines liability, collision, and comprehensive coverage. It protects against damages or injuries you cause to others, covers repairs to your car from accidents, and includes non-collision incidents like theft or weather damage. While it provides extensive protection, it doesn’t cover everything, such as mechanical breakdowns or normal wear and tear.

Is medical payment coverage the same as PIP?

No, medical payment coverage and personal injury protection (PIP) differ. Both help with medical expenses, but PIP also covers additional costs like lost wages and childcare after an accident. PIP is mandatory in some states, while medical payment coverage is usually optional.

How does gap insurance work for financed vehicles?

Gap insurance covers the difference between the actual cash value of your vehicle and the amount you owe on your loan or lease if your car is totaled. For example, if your car is worth $20,000 but you owe $25,000, gap insurance pays the $5,000 balance, ensuring you’re not financially burdened.

Are rental cars covered under my insurance policy?

Rental cars are often covered under your existing car insurance policy if you have comprehensive collision coverage. However, this depends on your insurer and policy details. Some providers also offer rental car reimbursement as an add-on to help with costs while your car is being repaired.

Can I change my coverage at any time during my policy term?

Yes, most insurers allow you to adjust your coverage during your policy term. You can contact your provider to make changes if you want to add optional coverages, increase liability limits, or remove unnecessary policies. Just be aware that adjustments may affect your premium.

Get Affordable Insurance With Cribb Insurance Group Inc

Looking for car insurance in Bentonville, AR? Cribb Insurance Group Inc offers comprehensive options that save money and protect you. Call us today at (479) 273-0900 to find the right coverage for your needs.