Many people rely on term life insurance for financial security during key stages of life. But what happens when term life insurance expires? Does term insurance expire, leaving you without options? This guide answers these important questions, helping you understand your choices after your policy ends and ensuring you can plan effectively for continued financial protection.

What Happens When Term Life Insurance Ends

When a term life insurance policy expires, the coverage you relied on ends. This means your beneficiaries no longer receive a payout, and you stop paying premiums. Understanding the impacts of expiry and how term life compares to permanent life insurance will help you make informed decisions moving forward.

Key Impacts of Term Insurance Expiry

When a term life insurance policy reaches the end of its term, the following changes occur:

- The coverage ends, leaving beneficiaries ineligible for any death benefit.

- Premium payments stop, meaning there are no ongoing financial obligations for the policyholder.

- If your policy included a return-of-premium rider, you may receive a refund of the premiums you paid throughout the policy term.

For some, allowing the policy to expire makes sense if financial responsibilities, like mortgages or dependents’ expenses, are no longer an issue. For others, additional steps may be necessary to maintain coverage for new or ongoing obligations.

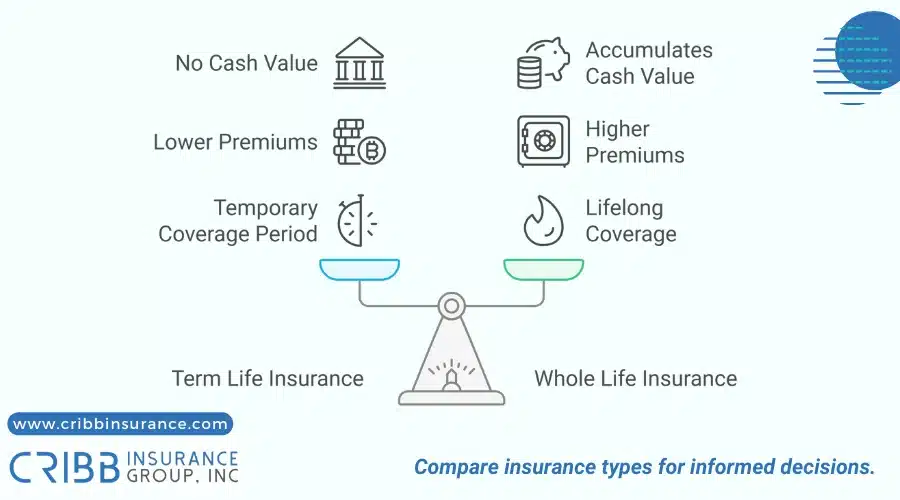

Differences Between Term and Whole Life Insurance

Term life and whole life insurance serve different purposes and meet different needs. Here are the key distinctions:

| Feature | Term Life Insurance | Whole Life Insurance |

|---|---|---|

| Coverage Duration | 10, 20, or 30 years (temporary coverage) | Lifelong (as long as premiums are paid) |

| Cost | Lower premiums due to limited coverage period | Higher premiums due to lifelong coverage and cash value |

| Cash Value | No cash value | Accumulates cash value over time, can be borrowed or withdrawn |

Choosing between these options depends on your long-term financial goals and whether you need coverage for a specific period or your entire life.

Can You Get Money Back After Term Life Insurance Expires

Many policyholders ask whether they can recover premiums after their term life insurance ends. While standard term policies do not return premiums, there are specialized options, such as return-of-premium riders, that provide a refund if you outlive your policy. Below, we explain how these riders work and whether they’re a good choice.

How Return of Premium Riders Work

A return-of-premium rider is an optional feature available with some term life policies. Here’s how it operates:

- During the policy term, you pay an increased premium to include the rider.

- If the policy expires without a claim, the insurer refunds the premiums you paid (without interest).

- This refund applies only to the base premium, not additional costs like administrative fees or riders for other benefits.

This rider can be appealing to those who want to protect their financial investment in life insurance, but it comes with higher upfront costs.

Is It Worth Paying Extra for Refund Options

Determining if a return-of-premium rider is worth it depends on your financial situation and goals. Consider these factors:

- Affordability: The rider’s cost may significantly increase your overall premium.

- Opportunity Cost: You could potentially invest the difference in a savings or investment account that generates higher returns over time.

- Risk Preference: For individuals who prefer guaranteed outcomes, this option might provide peace of mind, making the added cost worthwhile.

Ultimately, it’s important to calculate whether the long-term benefits of the rider outweigh the upfront cost compared to alternative financial strategies.

Should You Buy a New Life Insurance Policy

When term life insurance expires, purchasing a new policy is one way to maintain coverage. Deciding between a new term or permanent life insurance policy depends on your current financial situation, age, and future needs.

Benefits of Starting a New Term or Permanent Policy

Starting a new policy after your term life insurance expires provides continued financial protection. Here are some potential benefits:

| Feature | Term Life Insurance | Permanent Life Insurance |

|---|---|---|

| Flexibility | A new term life policy allows you to select a coverage period that fits your current stage of life, such as covering dependents until they become financially independent. | Permanent life insurance offers lifelong coverage and includes a cash value component that can be borrowed or withdrawn later. |

| Lifelong Security | Temporary coverage designed for specific financial obligations (e.g., mortgage, dependents’ education). | Lifelong security with benefits for estate planning or supporting special needs dependents. |

| Cost Considerations | More affordable due to limited coverage duration. | Higher premiums but includes a cash value feature. |

| Customizable Coverage | New term policies can be adjusted to match short-term financial needs. | Coverage can be tailored for lifelong goals, such as leaving a legacy or ensuring retirement security. |

By understanding these differences, you can evaluate which option aligns best with your financial goals. Whether you need flexible short-term coverage or a policy designed for lifelong security, the right choice will depend on your current stage of life and future priorities.

Factors Affecting Premiums for a New Policy

Premiums for a new life insurance policy may differ significantly from your original policy. Here’s what impacts costs:

- Age: The older you are, the higher your premiums will be since life insurance rates increase with age.

- Health Conditions: Any changes in your health since your last policy may lead to higher premiums or reduced coverage options.

- Policy Type: Permanent life insurance typically costs more than term life, though it provides additional features like cash value accumulation.

- Coverage Amount and Term Length: Higher coverage amounts or longer terms lead to higher premiums but offer greater financial security for your beneficiaries.

Tips to Plan Before Your Policy Expires

Planning before your term life insurance expires ensures you avoid gaps in coverage and unnecessary financial stress. Taking proactive steps can help you make informed decisions about your next policy or other alternatives.

Reviewing Coverage Needs Early

Before your policy expires, assess your current financial situation to determine if additional coverage is necessary. Consider these factors:

- Outstanding Debts: Check if you still have unpaid debts, like a mortgage or car loans, that would require coverage.

- Dependent Needs: Evaluate whether your children or other dependents still rely on your income for living expenses, education, or other financial needs.

- Future Goals: If you have long-term goals like funding retirement or leaving a legacy, consider how additional coverage might support these plans.

Avoiding Gaps in Coverage Through Strategic Planning

Gaps in life insurance coverage can leave your loved ones financially vulnerable. Follow these strategies to maintain seamless protection:

- Start Researching Early: Begin evaluating your options six to twelve months before your policy ends to avoid last-minute decisions.

- Consider Multiple Quotes: Compare rates and terms from different insurers to find the most cost-effective solution that meets your needs.

- Consult with Experts: Speak with a financial advisor or insurance professional to explore your options and identify the best policy for your circumstances.

What to Do When Your Life Insurance Is Expiring

When your term life insurance is approaching its end, there are several steps you can take to ensure continuous coverage. Whether you renew your existing policy, convert it to permanent life insurance, or explore other options, understanding the process will help you make the best decision for your needs.

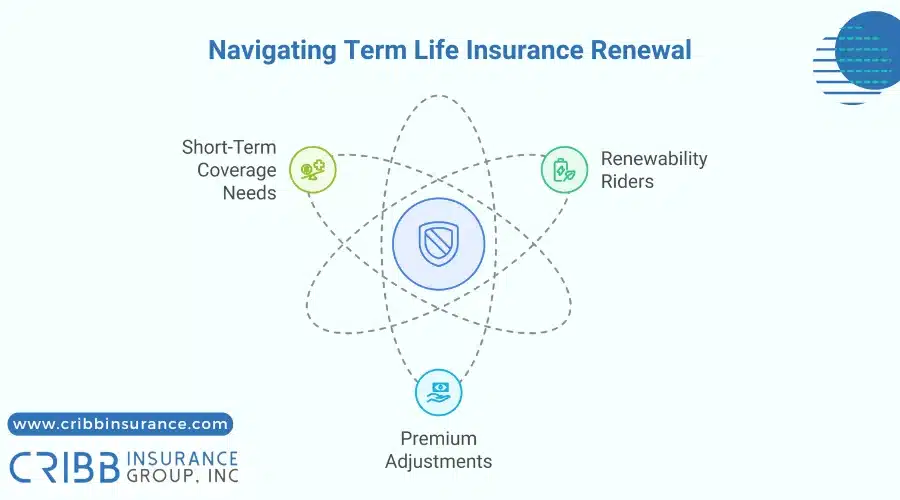

Steps to Renew or Extend Term Life Coverage

Renewing or extending your term life insurance can help you maintain financial security for a few additional years. Here’s how to approach this option:

- Check for Renewability Riders: Many term policies include a guaranteed renewability rider, allowing you to extend coverage without undergoing another medical exam. This is ideal if your health has changed since the policy began.

- Review Premium Adjustments: Renewing often comes with higher premiums due to age-related risks. Compare these costs to alternatives, such as purchasing a new term policy or converting to permanent coverage.

- Plan for Short-Term Coverage Needs: Renewal is usually best for covering temporary needs, such as supporting dependents for a few more years or settling remaining debts.

Understanding Conversion Options to Permanent Policies

Converting your term life insurance to a permanent policy offers lifelong protection and additional financial benefits. Here’s what you need to know:

- Confirm Conversion Eligibility: Check whether your current policy includes a conversion provision or term conversion rider. These allow you to switch to a permanent policy without a medical exam, often within a specific timeframe.

- Evaluate Long-Term Benefits: Permanent life insurance provides lifelong coverage and builds cash value, which can be used for loans or withdrawals. This is particularly helpful for estate planning or ensuring support for special needs dependents.

- Consider Partial Conversions: If full conversion is too expensive, some insurers allow partial conversions. This means you can convert part of your term policy to permanent coverage while maintaining lower overall premiums.

Making timely decisions about renewal or conversion ensures that you remain covered without unnecessary costs or delays.

Secure Your Family’s Financial Future with Cribb Insurance Group Inc

When term life insurance expires, understanding your options is crucial to maintaining financial protection. Whether you choose to renew, convert, or start a new policy, proactive planning ensures your loved ones are secure. Working with a trusted advisor like Cribb Insurance Group Inc can simplify the process and help you select the most suitable coverage for your situation.

Cribb Insurance Group Inc proudly serves Bentonville, AR, and offers personalized guidance to help you navigate term life insurance decisions. Don’t wait, act now to secure your financial peace of mind.

Frequently Asked Questions

What happens to unpaid premiums when term life insurance expires?

If term life insurance expires, unpaid premiums generally don’t result in penalties or obligations. Once the policy ends, you stop paying premiums, and the coverage is terminated. However, if your policy has a return-of-premium rider, any unpaid premiums during the term could impact your refund eligibility.

Can you have multiple term life insurance policies at once?

Yes, you can have multiple term life insurance policies simultaneously. Many people choose this strategy to meet varying financial needs, such as covering a mortgage and securing dependents’ futures. Ensure the combined coverage aligns with your financial goals and doesn’t exceed your affordability.

Is there a penalty for letting term life insurance expire?

There is no direct penalty for allowing term life insurance to expire. However, losing coverage can leave your loved ones financially unprotected. If you still need life insurance, delaying renewal or purchasing a new policy may lead to higher premiums due to age or health changes.

How do riders impact term life insurance costs?

Riders, such as return-of-premium or conversion riders, increase the overall premium of your term life insurance. While they add cost, they also provide additional benefits, such as refunds or the ability to convert to permanent insurance. Review the rider options carefully to assess their value based on your needs.

Does life insurance affect your taxes?

In most cases, life insurance payouts are not taxed for beneficiaries. However, certain scenarios, such as estate taxes for large inheritances or cash value withdrawals from permanent life insurance, may have tax implications. Consult a tax advisor to understand specific situations.

Take the Next Step for Your Life Insurance Needs

If your term life insurance is expiring, it’s time to secure the financial future of your loved ones. Cribb Insurance Group Inc in Bentonville, AR, is here to guide you through renewal, conversion, or purchasing a new policy. Call us today at (479) 273-0900 to explore the best options for your needs.