When it comes to protecting the financial future of your loved ones, life insurance plays a key role. It’s not just for certain groups of people—it’s a safety net that can help anyone at different stages of life. Whether you’re young and just starting out, supporting a family, or planning for retirement, life insurance can give you peace of mind and financial stability when it’s needed most.

So, who really needs life insurance? Let’s break it down into specific life situations where this coverage becomes invaluable.

Why Life Insurance is Essential for Financial Security

Life is full of unexpected turns, and while we can’t predict the future, we can prepare for it. Life insurance acts as a financial safety net that protects your family and dependents in case you’re no longer there to support them. It can cover daily living expenses, mortgage payments, education costs, or even leave a legacy.

For many, the idea of life insurance might seem unnecessary until they realize how it can positively impact their family’s financial health. Whether you’re single, married, a parent, or a retiree, having the right coverage can make all the difference.

Consider this: even if you have savings, they might not be enough to cover long-term expenses for your dependents. Life insurance guarantees payout, so your loved ones don’t have to worry about dipping into retirement funds or liquidating assets to survive.

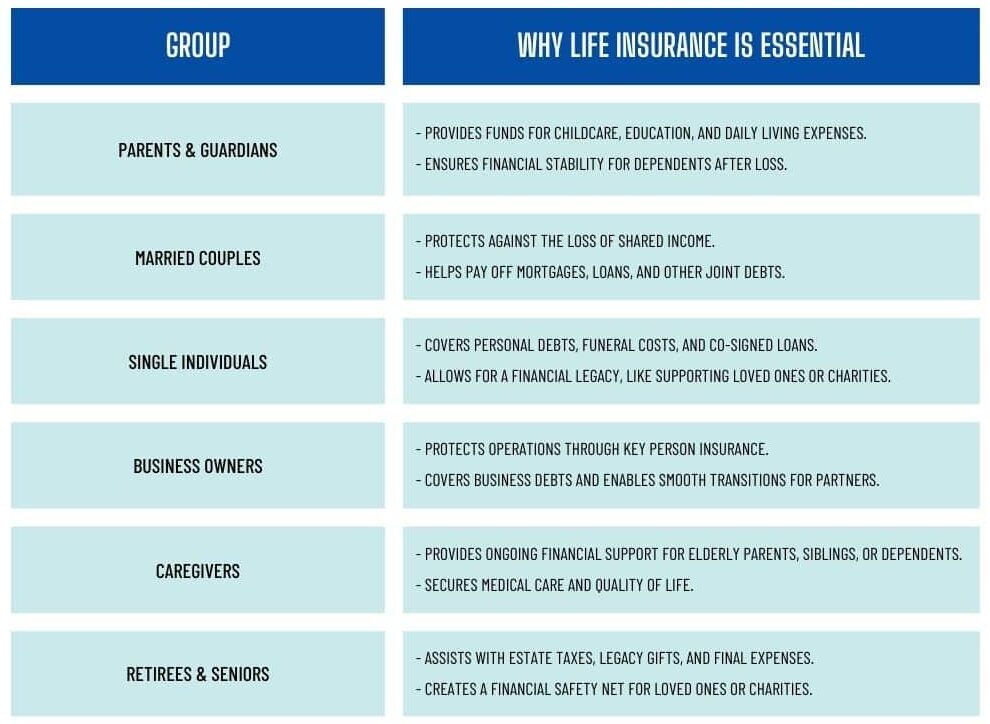

Who Needs Life Insurance? Key Benefits for Different Groups

Life insurance isn’t just for one specific group of people—it provides security for anyone with responsibilities, dependents, or financial obligations. Here’s a quick look at how life insurance benefits different life stages and situations:

Specific Life Situations and Why Life Insurance Matters

1. Parents and Guardians

Being a parent comes with a lot of responsibilities—both emotional and financial. You’ve likely thought about their future if you have young children or teenagers. How will your spouse or partner manage without your income? What about education expenses or daily needs?

Why it’s essential:

- Life insurance ensures your children’s future isn’t disrupted in case of an unexpected loss.

- It can help pay for childcare, groceries, and tuition fees.

- It allows your spouse or partner to focus on their emotional well-being instead of rushing to find additional income.

For example, think about this: the USDA estimates it costs over $233,610 to raise a child to adulthood (excluding college tuition). That’s a major financial burden that life insurance can help lighten for your family. Add in costs like sports fees, summer camps, or unexpected medical bills, and the number grows even larger.

Many parents need to pay more attention to the financial value of their role, whether they work outside the home or not. Even stay-at-home parents contribute significantly by providing services that would otherwise cost thousands per year.

2. Married Couples and Dual-Income Families

If you and your spouse rely on two incomes to cover your bills, mortgage, or savings goals, losing one income can cause significant strain. Life insurance can help your partner continue living comfortably without drastically changing their lifestyle.

Who needs life insurance most here?

- Working spouses who contribute to the family income.

- Stay-at-home spouses whose role often includes childcare and household management—services that can be expensive to replace.

A relatable example: Imagine one spouse handles the cooking, cleaning, and childcare while the other works outside the home. Without the stay-at-home parent, the surviving spouse may need to pay for daycare, which can cost up to $15,000 annually. Other hidden costs like cleaning services, meal deliveries, and tutoring can quickly add up.

Couples should also consider shared debts, like mortgages, car loans, and credit cards. Losing one income could mean struggling to keep up with these payments.

3. Single Individuals with Financial Responsibilities

You might think life insurance is only for those with dependents, but that’s not entirely true. If you have co-signed loans, personal debt, or funeral costs to consider, life insurance can help ensure your financial obligations don’t fall on family members.

When is it important?

- If you have private student loans or credit card debt.

- If you want to leave money to help family with end-of-life expenses.

- If you have aging parents or siblings who might need your support.

This policy can also help create a lasting legacy for single individuals, such as leaving funds to a charity or organization close to your heart. Consider life insurance a way to give back or support your values even after you’re gone.

4. Business Owners and Entrepreneurs

Running a business comes with its fair share of challenges. If you own a business, life insurance can provide a cushion to keep your business running if you’re no longer there to manage it.

Why business owners need life insurance:

- To protect business partners or co-owners with key person insurance.

- To cover outstanding business debts and keep operations going.

- To provide your family with financial support without selling the business.

For example, key person insurance ensures that the business can still function while finding a replacement if you or a critical employee passes away. This can be the difference between surviving or closing the doors for small businesses.

Business owners should also consider policies that provide buyout options, so partners can purchase shares without financial stress.

5. Caregivers Supporting Elderly or Disabled Family Members

If you care for aging parents, a sibling with special needs, or other dependents, life insurance can secure their well-being. Your role as a caregiver often extends beyond emotional support—you’re also their financial safety net.

How life insurance helps caregivers:

- It can provide funds to ensure dependents continue receiving proper care.

- It eliminates worries about finding alternative support if you’re not around.

- It creates a plan for covering medical costs, housing, and day-to-day needs.

Even a small policy can make a huge difference in maintaining the quality of care for those who rely on you. Caregivers often find that life insurance relieves a major source of stress, knowing their loved ones will be taken care of no matter what.

6. Retirees and Seniors Planning for the Future

For retirees, life insurance can help with legacy planning, estate taxes, or final expenses. Many seniors also use policies to pass on wealth to their children, grandchildren, or charitable organizations.

Consider this:

- The average funeral costs around $8,000 to $12,000.

- Some policies can act as a financial gift to loved ones or a community cause.

- Estate taxes can take a large chunk of inheritance—life insurance can help offset this.

Life insurance ensures you leave a financial plan behind, even if you’re living off retirement savings. Seniors can also use life insurance as a way to leave a lasting impact on family members or causes they care about.

Determining the Right Coverage for You

Choosing the right life insurance depends on your personal circumstances. Here are some factors to consider:

- Your income and debts.

- Current and future expenses (e.g., mortgage, tuition, care for dependents).

- Your family’s lifestyle needs.

- Potential estate taxes or other financial obligations.

For guidance, consider meeting with a local, trusted insurance expert who can help calculate the right coverage amount for your unique needs.

Life Insurance Myths: Debunked

Many people delay getting life insurance because of misconceptions. Let’s address some common myths:

- “I don’t need life insurance because I’m healthy.”

- Life insurance is most affordable when you’re young and healthy.

- “Stay-at-home parents don’t need life insurance.”

- Their role has significant financial value that’s often overlooked.

- “Life insurance is too expensive.”

- Policies can be tailored to your budget and needs.

- “Single people don’t need life insurance.”

- It can cover debts, funeral costs, and leave a legacy.

- “I can’t afford it right now.”

- Even small policies are available to suit tight budgets.

Protecting Your Loved Ones with Life Insurance

Life insurance isn’t just for one type of person. It’s for parents, singles, business owners, caregivers, and retirees—anyone who wants to protect the people they care about most. If you’re wondering, “who really needs life insurance?” the answer is simple: anyone who has people depending on them or responsibilities they’d like covered.

At Cribb Insurance Group Inc in Bentonville, AR, we’re committed to helping individuals and families find the right life insurance policy for their needs. Whether you’re just starting your financial journey or planning for the years ahead, we’re here to provide clarity and options that work for you.

Frequently Asked Questions

How much life insurance coverage do I need?

The amount of coverage you need depends on your income, debts, and the financial support your family might require. A common rule of thumb is to have 5-10 times your annual income.

Is life insurance worth it for young, healthy individuals?

Yes. Life insurance is most affordable when you’re young and healthy. Locking in a lower rate now can save money in the long run.

What happens if I stop paying for my life insurance policy?

If you stop paying premiums, your policy may lapse or be canceled. Depending on your plan, you might still access the cash value portion for permanent life policies.

Can life insurance cover funeral and end-of-life costs?

Absolutely. Life insurance can help cover funeral costs, medical bills, and other end-of-life expenses, so your family isn’t burdened financially.

Are there different types of life insurance policies?

Yes. The two main types are term life insurance, which provides coverage for a specific period, and whole life insurance, which offers lifetime coverage and a cash value component.

Ready to Secure Your Financial Future?

Life insurance is one of the most meaningful investments you can make for your loved ones. If you’re ready to explore your options, contact Cribb Insurance Group Inc in Bentonville, AR, today. Our team is here to guide you through the process and ensure you find the right coverage for your family’s needs.